How to Find Profitability in the E-scooter Sharing Industry – A Conversation with Bullride

When it comes to the future of e-scooter sharing, there are some pretty conflicting opinions out there. Some say it’s the future of micromobility, others are less optimistic.

Ultimately, the success of scooter operators all depends on their ability to find profitability.

Let’s be honest – this industry has higher-than-average overhead costs. The hardware itself is a major investment, and profits are further seeped by the maintenance workforce, storage, relocation costs, and new regulatory requirements that are regularly introduced.

But profitability is possible.

We spoke to Heiko Hildebrandt, co-founder of Bullride, which helps mobility companies offload their assets from their balance sheet to keep them in the black.

The State of the Scooter Industry – Hopeful

The economy is just starting to stabilize as we exit the Covid slump and enter the new normal. How did Covid affect the micromobility sphere?

A study published in Bloomberg found that monthly ridership fell drastically in 2021, but made a comeback in 2022 when people returned to office.

Now, that’s using US-based brands as a model.

Heiko Hildebrandt shares that the scooter operators he's worked with have experienced a similar effect:Corona was the greatest fuel you could pour onto the micromobility fire. During Corona times, people hardly used public transport, and most people switched to scooters. We saw two of the biggest micromobility brands in Europe, Bolt and Tier, raise record-setting VC investment at the end of 2021 – totaling 1.4B EUR – a clear sign of traction. And since Covid has ended, we've seen a 30%-40% slump in demand. So was Covid bad for business? Not according to my perspective.

However, according to Heiko, the real challenge is to make the unit economics work. Because the question is not about whether the product is in demand. The question is does it make sense from a business perspective.

The Challenges the Scooter Industry Faces

The scooter industry, while in demand, must face challenges that directly impact their unit economics. For some businesses, it pushes them over the edge and drives them into insolvency.

By knowing what those challenges are, scooter businesses can better set up their business models to protect their profitability.

Rising Hardware Costs

In order for a scooter’s lifetime to be profitable, it has to be in use for at least 2 seasons – some even say, for 4 years. That means that the scooter has to be durable, easily maintained, with cost-efficient replacement parts.

“Scooters are usually imported from abroad (mostly China), and shipping costs are now 8x higher than they were two years ago. The costs of electronics components are ever increasing.”

Jürgen Sahtel, Manager of the ATOM Vehicle Marketplace, agrees that the prices have gone up over the past two years.

“For example, hardware prices for the new Segway models have increased more than 40% over the last 16 months. And this trend is across all manufacturers – new scooters could be obtained starting from 650EUR and up, while more advanced models readily available in EU are priced at around 1000EUR per unit.”

The hardware is one of the biggest up-front investments that a scooter operator faces. But it’s also critical to balance cost with quality, as you need to be so resilient that it can withstand public use over the course of 2-4 years.

Expanding Regulation

When the e-scooter sharing industry took off, the industry was so fresh that there wasn’t any regulation in place to keep it in check. It was the wild west, and operators were able to take advantage of the regulatory grey area.

Now, municipalities are starting to crack down on the industry and putting laws into place. Regulation, overall, is a good thing. However, the way it’s done now shows a lack of understanding about the unit economics and its regulation that is being enacted.

“Most municipalities are limiting the size of a fleet that one scooter competitor can have. Their goal is to reduce the amount of scooter clutter on the streets. But that number is often too low to ensure what we call “natural floating” – the process of humans moving the scooters around the city. This puts a larger strain on relocation and charging teams.”

Other burdens placed on scooter brands is the stricter demarcation of allowable parking zones. This is a factor that impacts relocation teams – those responsible for bringing scooters from less popular zones back to city centers and transport hubs. Additionally, mandatory tenders with the municipality are usually offered only for one year, making planning rather difficult.

A new trend that Heiko mentions seeing from a regulatory perspective is the emergence of mandatory insurance.

“Scooters used to be classified as bikes, and thus, similarly regulated. Now, they’re being reclassified as motored vehicles, which have different regulatory requirements, including mandatory insurance.”

This further skews the unit economics of each ride.

On the other hand, regulation can also play an enabling factor. Heiko shares that if tenders could be extended for, say, 3 years, it could provide scooter brands with planning stability. If municipalities limited only 2 competitors in a city, this would ensure enough demand to make the unit economics work.

Finding Profitability in Unlikely Places – Bullride’s Unique Business Model

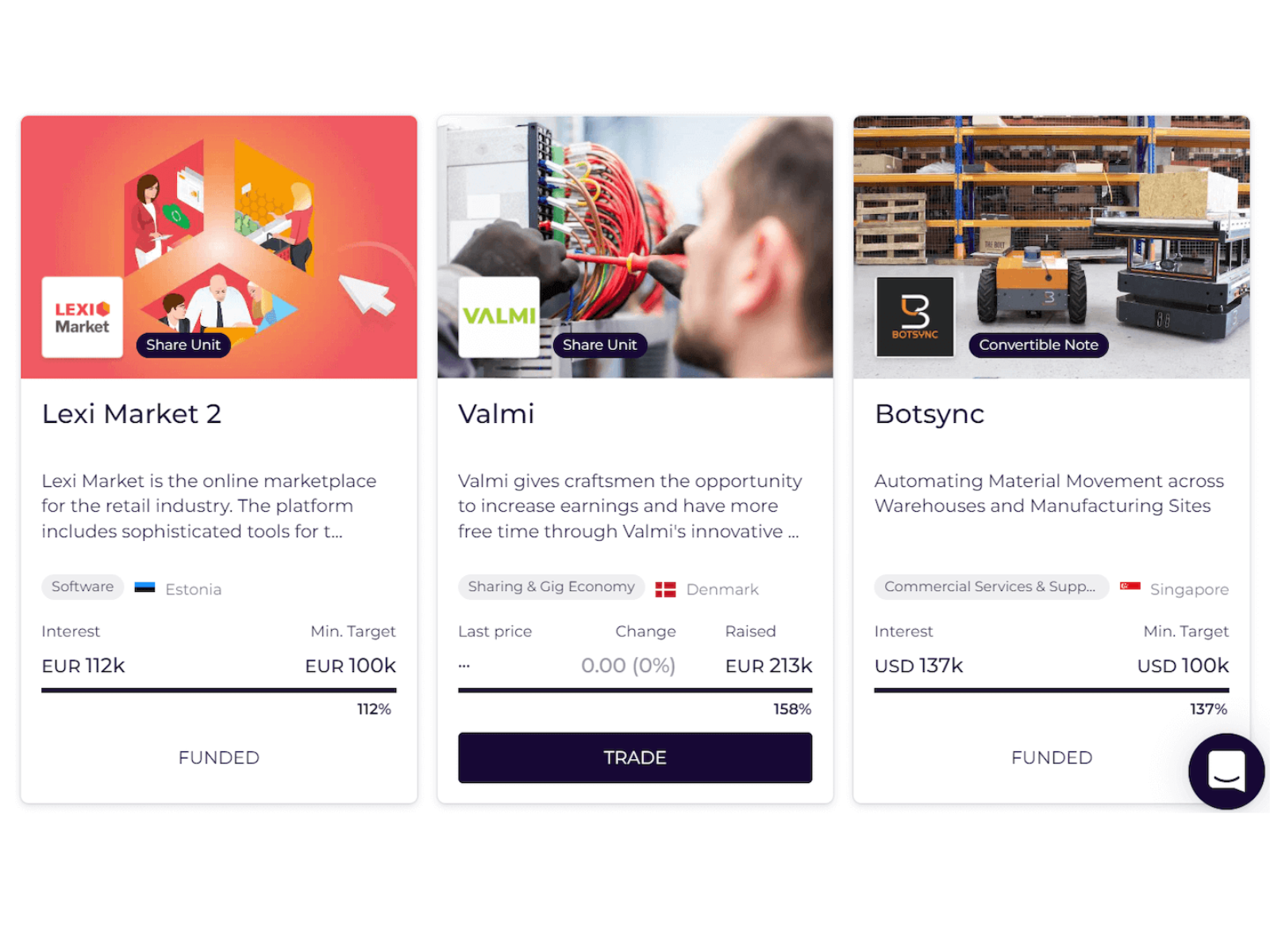

Heiko believes that the future lies in the shared economy. He’s among the 4 co-founders of Bullride, an investment platform that shoulders the burden of the hardware investment and splits the scooter rent with the operating brand.

How does it work?

- The Bullride platform crowdfunds the costs of the initial scooter investment. These people become your investors. Instead of giving away equity (ownership) of your company, they end up “owning” one of your scooters (1 scooter = 1,000 EUR).

- The order is made into one of the top scooter manufacturers that have the best longevity – Bullride does this for you.

- You split the rental income – 55% for you, 30% for investors, 15% for Bullride.

The idea works for a number of reasons.

- You’ll need money. A bank is unlikely to fund a scooter venture (because of historically low profitability), and a VC will ask for equity. This way, you get the investment, while retaining full control.

- Bullride has very specific requirements. They know what works, and what doesn’t. They only work together with entrepreneurs that meet their very strict requirements. That includes entering a city that has no more than 2 competitors, and a city that has no more than 100,000 inhabitants. 30,000 is the ideal sweetspot. You also only have one employee – and that’s you.

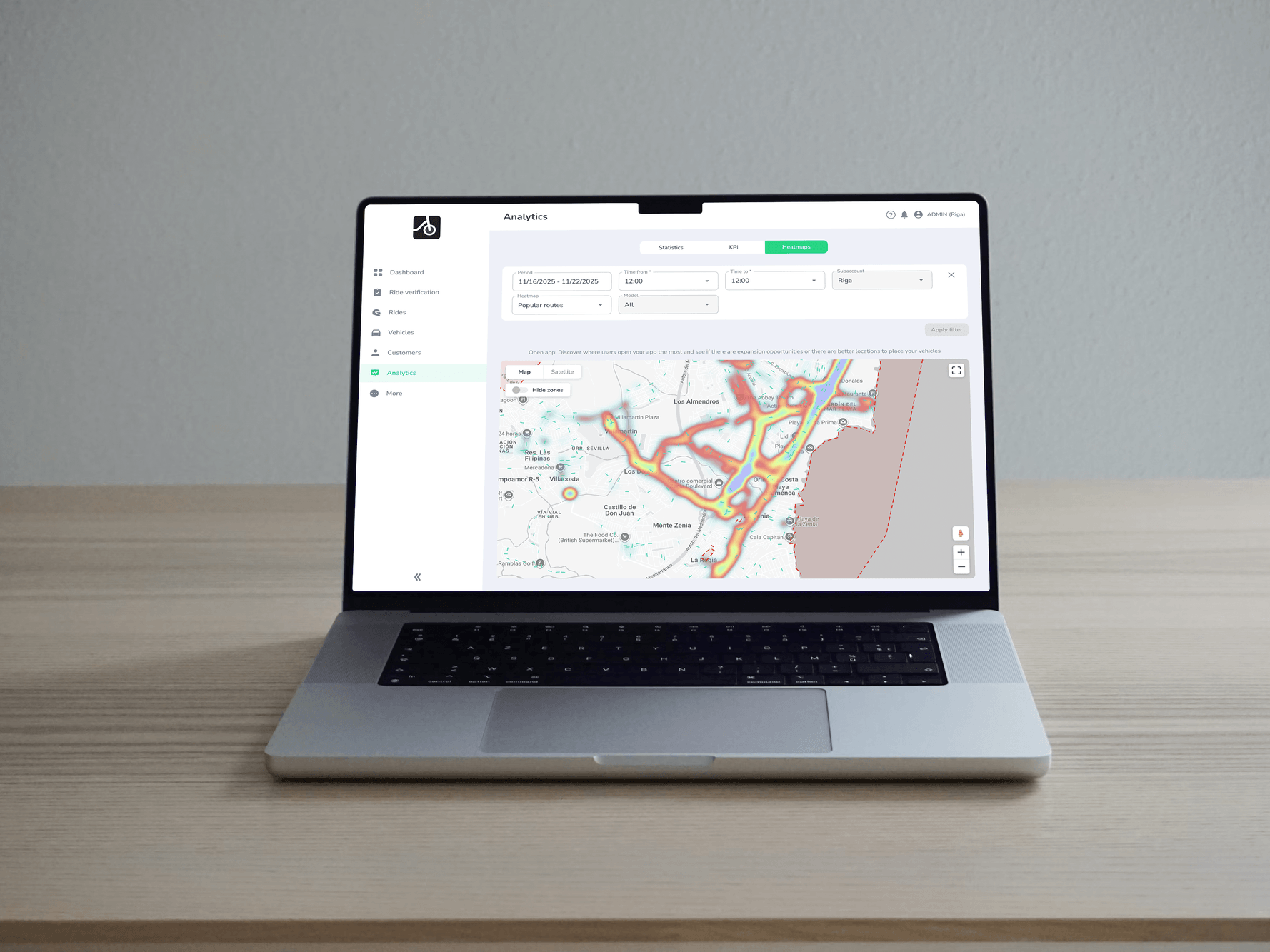

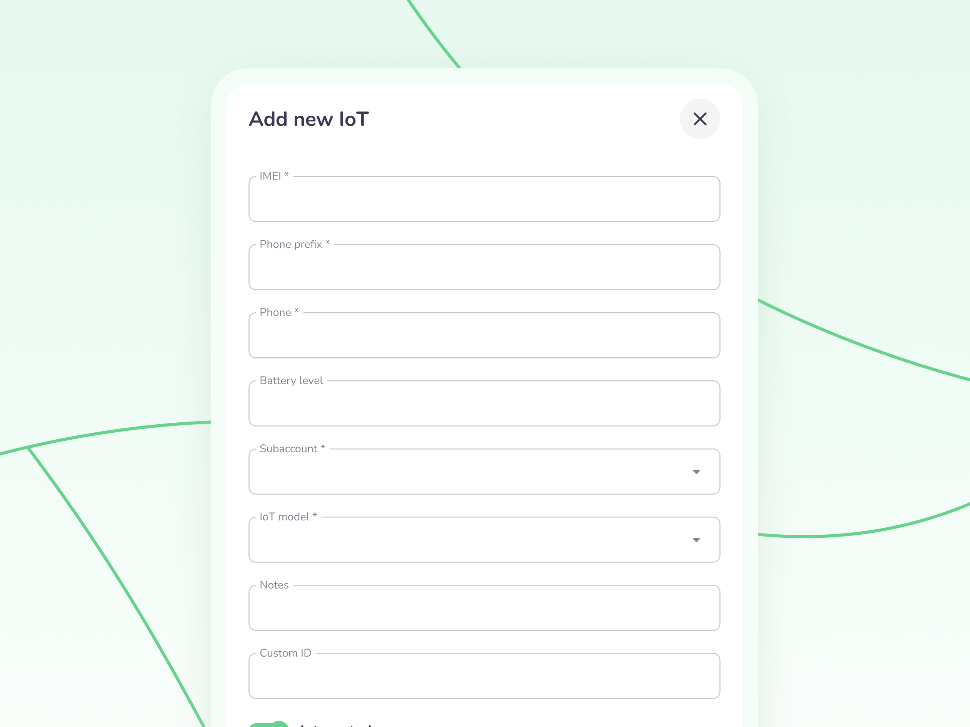

The operating brand then may use a leading vehicle-sharing platform ATOM Mobility, to fast-track their time to market. ATOM takes profitability even further with its unique pricing model. Instead of the common model of cost-per-vehicle, ATOM uses a cost-per-ride model. That means that if you have less demand (and as a result, less income) in a certain month, then you pay less for use of the ATOM platform.

But scooter sharing is just the beginning. This same model, Heiko believes, can be applied to e-bikes, e-scooters, carsharing, even wind turbines and major investments like that. Why shouldn’t a community be able to jointly invest in and co-own the infrastructure that they need to live?

This is a unique model that hasn’t been commonly seen elsewhere. It’s more than just scooters – Bullride believes that at the heart of it, what they’re doing is democratizing asset ownership.

If you’re looking to launch or scale your own vehicle-sharing business, to learn more abut this opportunity.

This article was originally published by ATOM Mobility.