ATOM Mobility: Crowdfunding for Your Vehicle-sharing Business – What Are the Options & How To Get Started

Having a great business idea is rarely enough – you also need money to get the ball rolling. But what if you don’t have tens of thousands just laying around to bootstrap your business? Or don’t want to go the traditional way and attract VC funding in exchange for a large number of company shares?

This is where many founders choose to crowdfund.

Crowdfunding is a way of raising money for your business from a large number of people through online platforms. In 2000, ArtistShare became the first dedicated crowdfunding platform, and since then, crowdfunding has become one of the top funding sources for businesses, with the global market estimated to reach $300 billion by 2030.

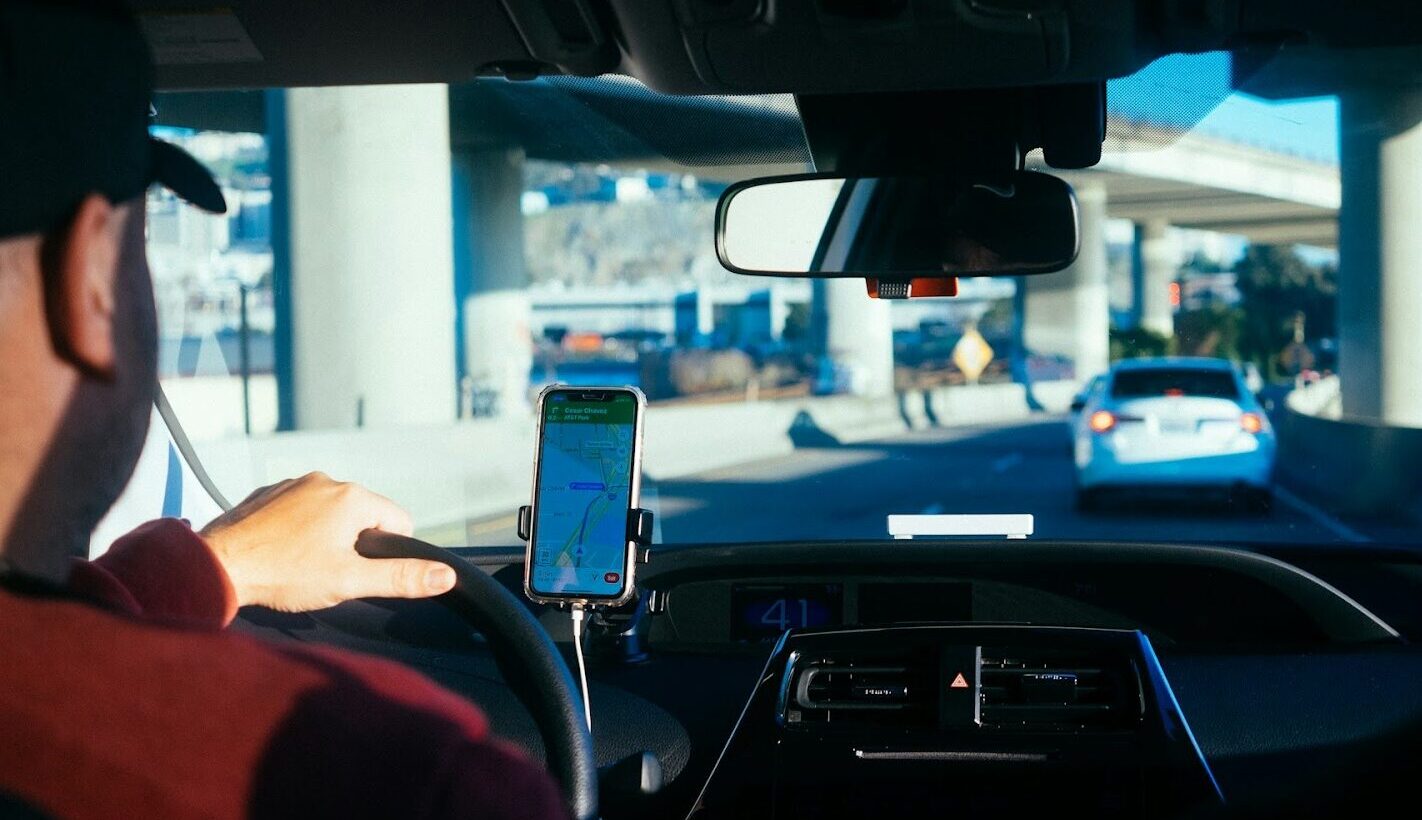

If you’re looking to fund your vehicle-sharing business, crowdfunding might be one of the options. It can not only help you attract money but also test your business idea in the first place. After all, if enough people are ready to back your idea, it’s a clear sign it has a place in the market.

Types of Crowdfunding Platforms & Their Investors

For your vehicle-sharing business, there are three main types of crowdfunding to consider – rewards, debt, and equity. Let’s take a closer look at each of them!

Rewards

This is considered the “traditional” type of crowdfunding and is currently the most popular. The idea is simple – people contribute to a business idea, expecting to receive a reward, such as products or services, at a later stage.

Platforms for rewards-based crowdfunding (few examples):

- Kickstarter

- Indiegogo

Who are the backers?

Regular people with little or no experience in investing; early adopters – people who embrace new things before most other people do. Generally, these people invest because they truly believe in the idea and want to help it come to life, as well as because they just want to be the first in the world to receive the product.

Best for: Businesses at early stages – idea or early development. Rewards crowdfunding is also for established businesses looking to launch a new product or expand to new markets.

Debt

Debt-based crowdfunding – also known as peer-to-peer (P2P) lending – means that the crowd lends money to a company, which it needs to repay with interest by a certain deadline. The idea is similar to borrowing a loan from a bank, except that in this case, there are many lenders instead of one.

Platforms for debt-based crowdfunding (few examples):

- LendingClub

- Honeycomb Credit

Who are the lenders?

Lenders that support companies via debt-based crowdfunding are individual investors looking to earn a higher profit on their cash savings and/or diversify their portfolio. These investors care about two things – whether the company will be able to repay the loan and how much they’ll earn in interest payments. Everything else is secondary.

Best for: Companies with a stable revenue that can more or less accurately predict their cash flow to repay their lenders. Generally, this is for companies at different stages when they’ve started to make a profit.

Equity

Equity-based crowdfunding allows businesses to give away a portion of their company to a number of investors in exchange for investment. Investors receive shares in the company based on how much money they’ve contributed.

Typically, equity-based crowdfunding is done in a way that first, the crowdfunding platform takes the company’s equity, then sells the shares on their platform.

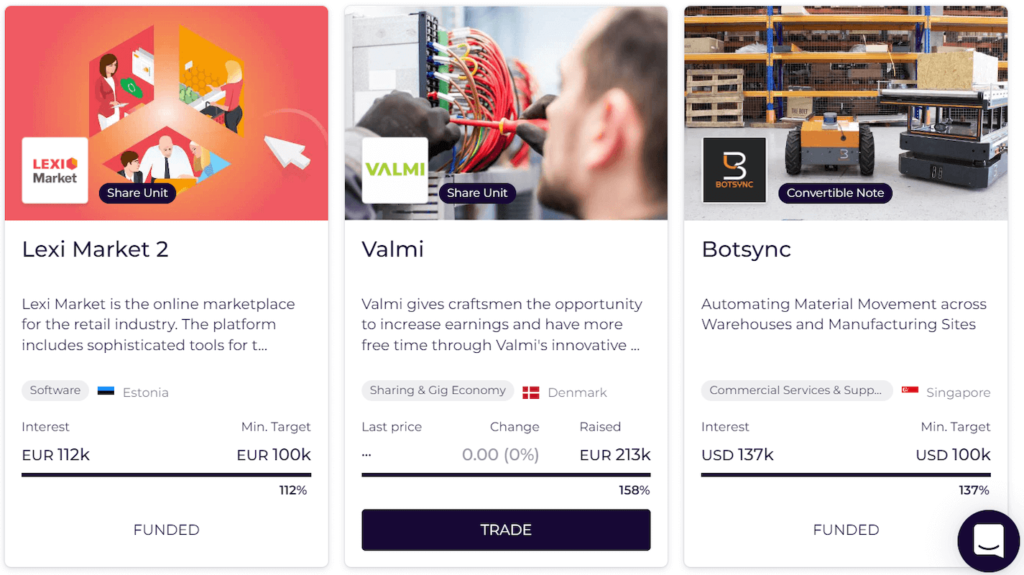

Platforms for equity-based crowdfunding (few examples):

- Funderbeam

- Seedrs

Who are the investors?

Typically, these are quite seasoned investors with experience in stock and/or startup investments who are now looking for higher-risk, higher-yield investments. These people might be less interested in the idea or cause behind the business and more in its potential future growth and profits.

Best for: Businesses at all growth stages, except for the exit/acquisitions stage.

How Much Can You Expect To Raise With Crowdfunding?

How much a successful crowdfunding campaign raises can differ greatly depending on the stage of your business and the type of crowdfunding you’ve chosen.

For example, according to the equity-based crowdfunding platform Seedrs, businesses with MVPs usually raise between €30k and €50k, whereas early-stage businesses – between €50k and €250k.

In the meantime, on Kickstarter, the rewards-based crowdfunding platform, the majority of successfully funded projects raise less than $10k. Tech products typically raise between €20k and €100k.

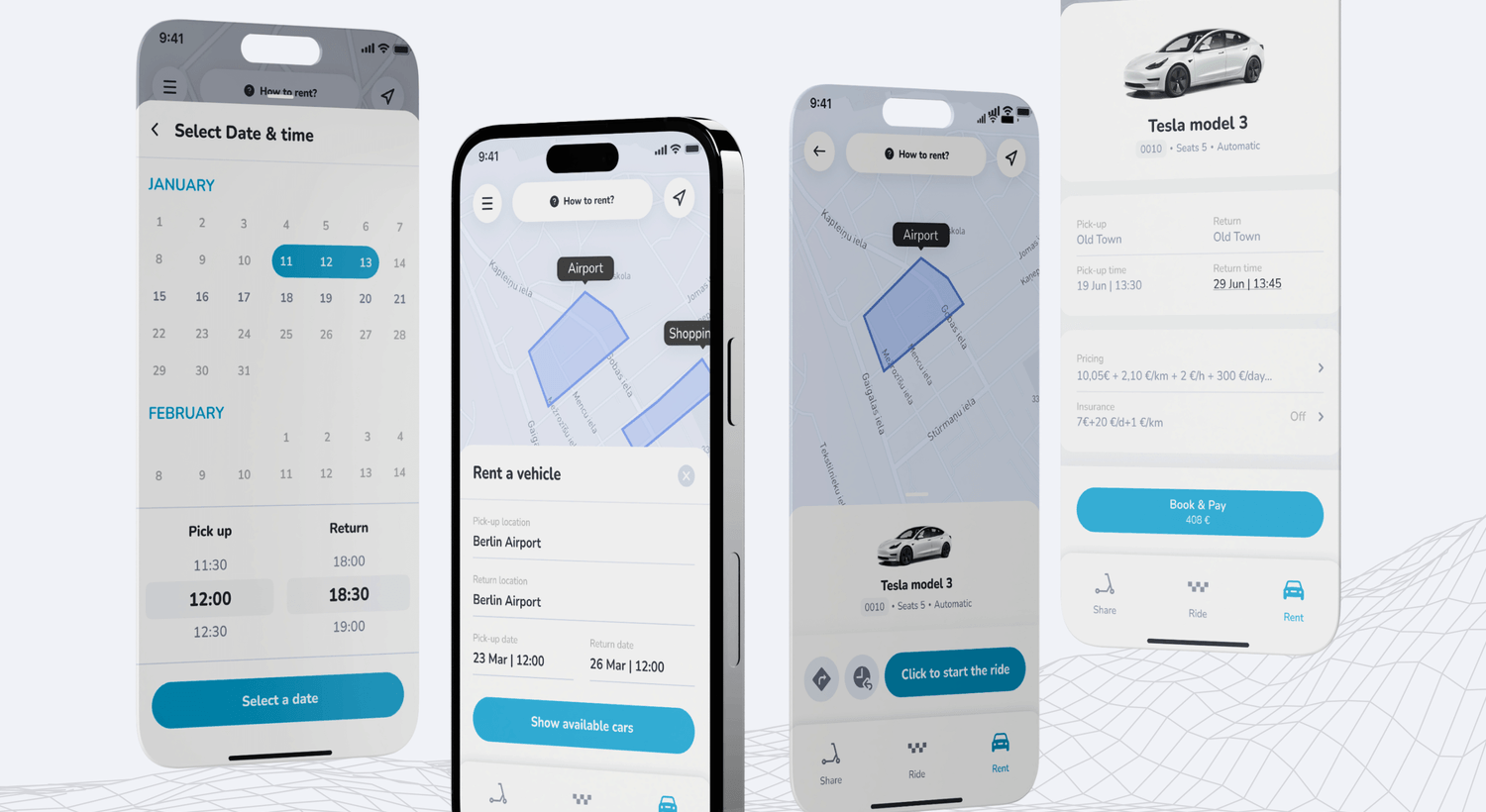

How about vehicle-sharing businesses? Here are two successful examples:

- Electric bike-sharing company Mobi raised €794,891 on Spark Crowdfunding.

- Scooter-sharing startup tretty raised €62,635 from 170 backers with their rewards-based crowdfunding campaign via StartNext.

- Bike and scooter sharing company Frog Mobility raised €138,814 – 40% of their set funding goal – via equity crowdfunding platform Spark Crowdfunding.

- Mount, a PaaS for Airbnb hosts to offer shared vehicles to their guests, raised $133,460 via WeFunder.

To start a bike-sharing or scooter-charing business with 40 vehicles, you should aim for at least €40k. This is doable with all types of crowdfunding models if done right.

Now, let’s see what “right” means and how to make your crowdfunding campaign a success.

How To Succeed With Your Crowdfunding Campaign

A successful crowdfunding campaign can help you get your business off the ground and raise even more funds than you had expected. The harsh reality, however, is this: as many as 85% of crowdfunding campaigns fail and never reach their set goal.

To increase your chances of a successful crowdfunding campaign here’s your basic to-do list:

Choose the right platform: This depends on your funding goal, the stage of your business, the type of your product, and even your target market. For example, AppBackr is an app-specific crowdfunding platform, StartNext is for products for the German market, while Kickstarter is only available to creators in 25 countries.

Understand your investors: People backing projects on Kickstarter vs Funderbeam can differ greatly. For example, on Kickstarter, people are more interested in the “coolness” of the product, whereas investors funding companies via debt-based or equity-based crowdfunding platforms care more about the company’s projected growth and cash flow, and the money this investment is going to make them. Keep this in mind when crafting your pitch!

Start preparing early: One of the key secrets to launching a successful crowdfunding campaign is investing heavily in pre-campaign lead generation. Start building a community and an email list of supporters as early as you can – these people will give your campaign the necessary first push to succeed. You should aim to collect 30% of your funding goal within the first week – then, the campaign is likely to reach the goal.

Craft a compelling pitch: Good storytelling is the key to your campaign’s success, no matter who your investors are. That said, the stories they want to hear differ. For a reward-based campaign, craft a story around your product that evokes emotions – make people laugh, help them imagine themselves with your product, or be angry about the issue it’s going to solve. For an equity-based campaign, you should focus more on highlighting your team’s strengths, market knowledge, and long-term vision.

A range of rewards: Apart from an option to buy your product, it’s recommended to include some lower-priced options for people who just want to support you. For example:

- Weekly or monthly subscriptions to your service

- Free credits to use your service

- Ad space on your product

- Partnership packages

- Priority delivery of the product or access to the service

- Product accessories

- Guided city tours

Other things that can help you launch a successful crowdfunding campaign include:

- Professional visuals – this is essential for making a good first impression

- Videos – they help issuers earn 105% more

- Posting regular updates – those boost your chances of raising 126% more

- Data and stats that make you look reliable – previous successful projects, business traction, existing customer reviews, and testimonials

- Social media presence – when you share your project on social media platforms, your probability of success increases. For example, if you share to 100 or 1,000 followers, the probability of success increases by 20% and 40%, respectively.

To Conclude

One of the biggest mistakes founders make is assuming that it’s enough to have their campaign launched on the chosen crowdfunding platform, and people will come and invest in it.

The reality, however, is this:

A successful campaign requires a lot of work outside the crowdfunding platform – you need to proactively and systematically look for supporters and persuade them to invest. So, to improve your chances of succeeding, start preparing months before the launch of the campaign.

This article was originally published by ATOM Mobility.