How to Choose the Best Payment Gateway for Your Mobility Business?

As you’re getting close to launching your vehicle-sharing business, one of the important decisions is what payment gateway to use. Without one, you won’t be able to collect payments from users via app. But choosing the right solution might feel daunting since so many options are available.

The good news is – we’ve got you covered.

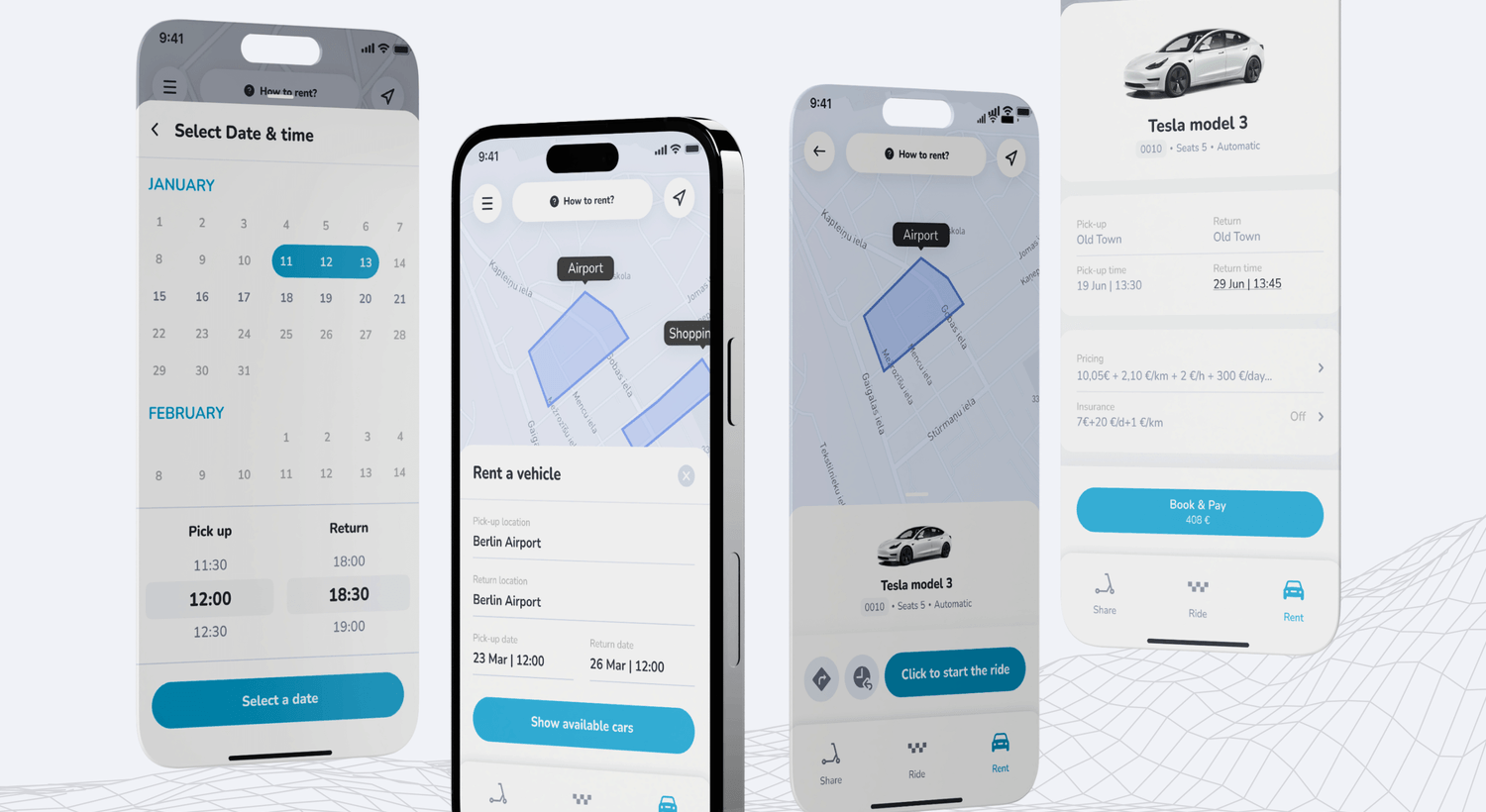

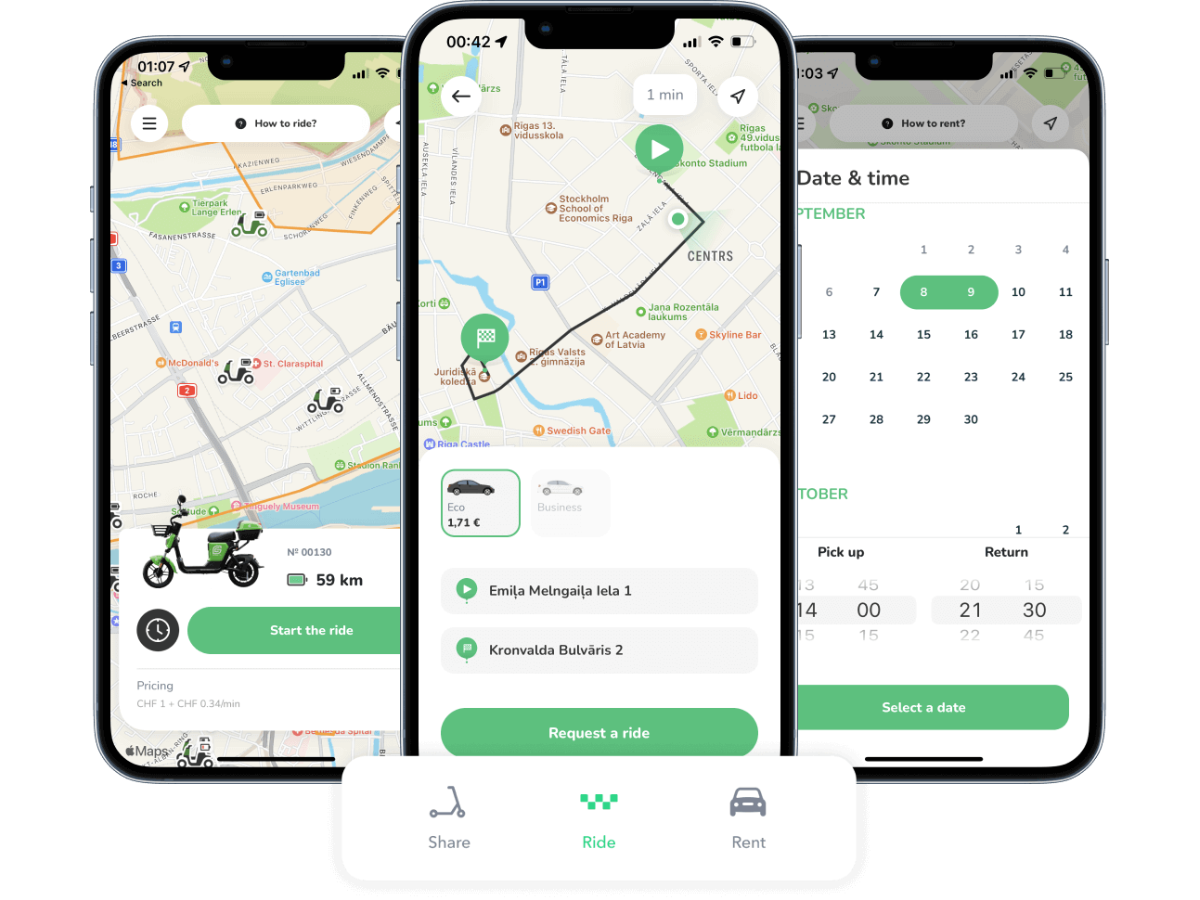

In this article, you’ll find an overview of what payment gateways are, what payment processing solutions integrate with ATOM Mobility, and the key factors to consider when choosing a payment gateway for your shared mobility venture.

What Is a Payment Gateway?

Simply put, a payment gateway is the “bridge” between the customers’ payment method and your bank account. It’s the tool that validates your customer’s card details or credentials for online payment methods (e.g., digital wallets such as ApplePay) to ensure that funds can be transferred to you, the operator.

For ATOM Mobility users, there’s an option to choose between two types of payment gateways:

Hosted, when the client is taken to an external payment page hosted by the payment gateway provider to enter their payment details, such as credit card information or login credentials (e.g., PayPal or local bank integrations). In our case, the payment page opens in-app, meaning that the end customer won’t know the payment takes place outside of the app.

Self-hosted/native SDK integration is when the payment gateway system is integrated into the app, allowing the client to complete the payment without leaving the site.

Most businesses nowadays use such hosted and integrated payment solutions – those are quick and easy to set up, and the solution provider takes responsibility for transaction validation and security.

How Do Hosted and Integrated Payment Gateways Work?

Your business most likely has a bank account used to manage the company’s cash flow. It’s, for example, where you make and receive payments for invoices issued.

Now, to start accepting payments at scale, you need to set up a payment gateway that will allow you to automate the process of collecting payments. It’s impossible to manually prepare and send an invoice to every customer for every ride – those could be thousands of invoices a day for relatively small amounts.

Payment gateways link your bank account with the customer’s chosen payment method that they’ll be asked to add when downloading your app. From then on, whenever clients use your shared mobility solution, your payment gateway will collect the money, then transfer it to your bank account within few days.

For their service, payment gateway service providers charge a processing fee, which can be either a specific amount or a percentage of the transaction value. The fees vary depending on the service provider, the type of card the client has added, and more.

For example, Stripe’s regualar fee is 1.5% + €0.25 for European cards. For a €4 transaction, they’d charge 1.5% of €4 + €0.25. That’s a €0.265 commission in total.

As you estimate your business’ expenses and potential profits, such processing fees must be carefully considered. In the shared mobility industry, such microcharges can quickly add up and “eat” as much as 6.6% of your revenue (see the Stripe example above).

Payment Gateway Providers That Integrate with ATOM Mobility

The ATOM Mobility platform integrates with a number of payment gateway solutions, which will allow you to collect payments wherever your business is based. Once you’ve chosen the one that’s right for your business and set up the account, you can connect it to your ATOM Mobility account.

But first things first – here are the many options available to you:

Stripe

Stripe is one of the most popular payment processing solutions worldwide, allowing businesses to accept and manage online payments. It enables businesses to accept credit and debit card payments, digital payments, and more. Stripe also supports Apple Pay, Google Pay, Bancontact, iDEAL and more.

Pros

- Supports 135+ currencies

- Easy to set up, with an intuitive user interface

- Supports a wide range of payment methods

- Transparent pricing – flat rate per transaction, no monthly fees

- With the help of ATOM Mobility, you can get a significant discount on transaction fees

Cons

- Doesn’t operate everywhere in the world

- Fees for international transactions can be higher than competitors’

Payment Processing Fee (without Discounts Provided to ATOM Mobility Clients):

- 1.5% + €0.25 for European cards

- 2.5% + €0.25 for UK cards

- 3.25% + €0.25 for international cards

Adyen

Adyen is among the largest companies in the payment processing market. This payment processor supports over 250 payment methods, including Apple Pay, Google Pay, PayPal, and Klarna.

Pros:

- Supports 187 currencies

- A wide range of payment methods and currencies supported

- No monthly or setup fees

Cons:

Transaction fees may be a bit unpredictable, as they vary a lot depending on the payment method

Adyen requires new merchants to have at least 1 000 000 EUR in annual turnover, so it may be complicated to open an account. ATOM Mobility can assist with special conditions, as our customers have no minimum threshold.

Payment Processing Fee:

- €0.11 + payment method fee (see here)

Checkout.com

Checkout.com allows merchants to accept payments from a variety of payment methods, including credit and debit cards, various alternative payment methods (PayPal, digital wallets), as well as various local payment methods. Checkout.com has great coverage where Adyen or Stripe do not operate.

Pros:

- Supports transactions in 150+ currencies

- Easy to set up, clean and intuitive interface

- Quick payouts

Cons:

- The pricing structure is a bit complex & fees may vary depending on transaction volume

- Supports 18 payment methods – less than their competitors

Payment Processing Fees:

- 0.95% + $0.20 for European cards

- 2.90% + $0.20 for non-European cards

HyperPay

HyperPay provides payment processing solutions for businesses of all sizes and enables operators to accept both card and digital payments. HyperPay covers the MENA area – Middle East North Africa – and integrates with the ATOM Mobility system.

Pros:

- Easy to set up and integrated with the operator’s website or mobile app

- Supports a wide range of payment options – payment cards, digital wallets, MADA, bank transfers

Cons:

- The pricing structure is a bit complex & fees may vary depending on the payment method and the volume of transactions

- You can’t just create an account – you must get in touch with HyperPay to do it

Payment Processing Fees:

Depends on the currency and payment method; not stated on the website.

Bambora

A payment processing solution that’s available in multiple countries around the world. It offers a range of payment options, including credit and debit cards, e-wallets such as PayPal and Alipay, and more.

Pros:

- Supports payments in multiple currencies

- Supports a variety of payment options – including AliPay, which is widely popular in China

Cons:

- Not available in all countries

- Setting up Bambora can be a bit complex for those with limited technical expertise

- $49 set-up fee

Payment Processing Fees:

Fixed fee ($0.10-$0.30) + percentage fee (1.7%-3.9%)

Regional Payment Solutions

ATOM Mobility integrates with several regional payment gateways, which is helpful for businesses focusing on specific markets. Providing users with an option to pay for your services in their local currency and with a payment method they’re familiar with, helps ensure customer satisfaction and loyalty.

A payment gateway for businesses in Latin America. Processing fees depend on the country and payment method but typically are between 2.5% and 5% per transaction.

A payment gateway for businesses in Africa. Transaction fees depend on the payment method and the volume of transactions – usually between 2.9% and 3.8% per transaction.

A payment system is primarily available in Ukraine and other countries in Eastern Europe. Payment processing fee – 1.5% per transaction.

A payment processing platform that’s primarily available to businesses based in Ukraine. Fees for card transactions range from 1.5% to 3%.

A payment solution for businesses in the Baltic region of Europe. It allows users to make a payment by simply entering their phone numbers. Payment transaction fees start at 1.3% or min. €0.10.

A payment gateway that provides online payment solutions for businesses in Azerbaijan. The fee for card transactions is 5%.

Local Bank Integrations

Another option is to offer your clients to pay through their local bank integration. Since people tend to prefer payment solutions they are familiar with, offering your clients the option to pay through their local bank integration may help you convince new users to give your ride-sharing service a try.

A bank integration primarily for businesses operating in Azerbaijan, Bulgaria and Albania. Fees for card transactions typically range from 0.7% to 1.5%.

A bank integration primarily for businesses operating in Ukraine. Fees for card transactions typically range from 1.5% to 2.5%

A bank integration for businesses primarily operating across the Caribbean and Central America. Fees for card transactions vary – contact the bank for more information.

New Integrations

Currently, the ATOM team is working on 3 new payment integrations so our clients have more options and can find the most suitable solution for them. If you have a preference regarding the payment gateway, you can talk to our team, and we will plan the integration process together.

Key Factors to Consider When Choosing a Payment Gateway

As you see, there are dozens of payment gateway solutions available. But which one is the one and only for your business?

Before you make your decision, here are six crucial things to consider:

- Stability and SLA – how secure and stable the solution is. This should be the first criterion, as cooperating with an unstable solution will lead to losses. Do other similar businesses use them? Do they have case studies? Does their support answer within a reasonable time?

- Costs and fees – what will it cost you to set the solution up? How big are the transaction fees? Are there any additional monthly fees? Try to estimate the volume and value of your monthly transactions – for many payment gateway solution providers, the fees depend on these factors.

- Payment methods supported – people are different, and so are their preferences regarding online payments. Some prefer to pay with digital wallets, while others only trust banks and their integrations. The more payment methods you’ll be able to offer, the larger audience you’ll be able to attract.

- Regions operating in – does the chosen payment gateway even work in your region? Also, if you’re aiming to build a global ride-sharing business, you may want to select a payment gateway with a worldwide presence.

- Holding time – how long can the funds be cleared and transferred to your bank account take? For most payment gateways, it’s usually 3-7 days. Generally, the sooner you receive your money, the easier it will be for you to manage your business.

- Currencies supported – check whether your payment gateway supports payments in different currencies. People want to pay in their local currency, so you want to ensure they have such an option.

- Security – as a rule of thumb, you want your payment gateway to be level-1 PCI DSS compliant and have fraud detection features.

To Sum Up

Choosing the most appropriate and cost-efficient payment gateway may feel daunting at first, but the secret to making this process easier is just knowing exactly what you want and need.

- Where is your business going to operate?

- How big is your target market?

- How much can you make in your first year in business? Be realistic.

- Where do you see your venture in 3-5 years?

By answering these questions, you’ll have a clearer picture of what you need from your payment gateway solution provider.

Good luck!

This article was originally published by ATOM Mobility.