The carsharing industry is at a crossroads. Once hailed as the future of urban mobility, it has seen a mix of success and failure, with some players thriving and others closing shop.

So we ask: why do some carsharing ventures fail while others continue to grow? And more importantly, what does it take to run a sustainable and profitable carsharing business in today’s competitive landscape?

Recent developments have been telling. Two OEM-backed carsharing ventures have recently shut down, while independent operators continue to expand, and a new entrant – Kia – has just launched its own service. This article takes you into the challenges, key success factors, and the evolving role of technology in the industry.

OEMs vs. Startups: What’s the Difference?

Before diving into specific cases, it’s important to clarify what OEMs (Original Equipment Manufacturers) are and how they differ from startups. OEMs are traditional car manufacturers – companies like Kia, Volvo, or Ford – that primarily produce and sell vehicles under their brand names. Some OEMs have expanded into mobility services, including carsharing, but often struggle because their main focus remains on car sales.

In contrast, startups and independent operators like GreenMobility are built from the ground up as mobility service providers. They don’t manufacture cars but instead focus entirely on the carsharing experience, optimizing operations, technology, and customer service. This difference in core focus often determines success or failure in the carsharing industry.

OEM Carsharing Ventures

Automakers have long recognized the potential of carsharing as a way to diversify revenue streams, enhance brand loyalty, and explore new mobility business models. However, history has shown that simply putting cars on the streets and creating an app isn’t enough to make carsharing work.

Several OEM-backed carsharing services have struggled to maintain profitability. Volvo’s Volvo On Demand recently announced its closure as part of a broader strategy to optimize costs. Similarly, SEAT ceased operations at the end of 2024 due to declining demand and rising operational costs (€31 million total losses, with €11 million lost in 2023 alone, against a turnover of €16 million).

The challenges OEMs face in carsharing stem from several factors:

- High operational costs: Fleet management, maintenance, insurance, and parking fees add up quickly.

- Consumer behavior: Unlike leasing, carsharing requires a behavioral shift from users, who must plan trips around vehicle availability.

- Integration challenges: Traditional automakers are structured around car sales, not service-based mobility solutions. This makes it difficult to operate carsharing efficiently.

However, these closures don’t necessarily mean that carsharing itself is an unsustainable model. Instead, they highlight the need for a different approach – one that independent players are executing more effectively.

New Entrants and Independent Operators

While OEM carsharing ventures struggle, independent operators like GreenMobility are experiencing growth. Unlike traditional automakers, these companies are built from the ground up as mobility service providers, allowing them to operate more efficiently.

GreenMobility’s growth can be attributed to:

- A laser focus on carsharing: Unlike OEMs, which juggle multiple business lines, independent companies dedicate their entire strategy to optimizing the carsharing experience.

- Smart cost control: Leveraging technology for fleet management and maintenance allows them to run lean operations.

- Strategic market selection: Choosing the right cities with high demand and favorable regulatory environments plays a huge role in their success.

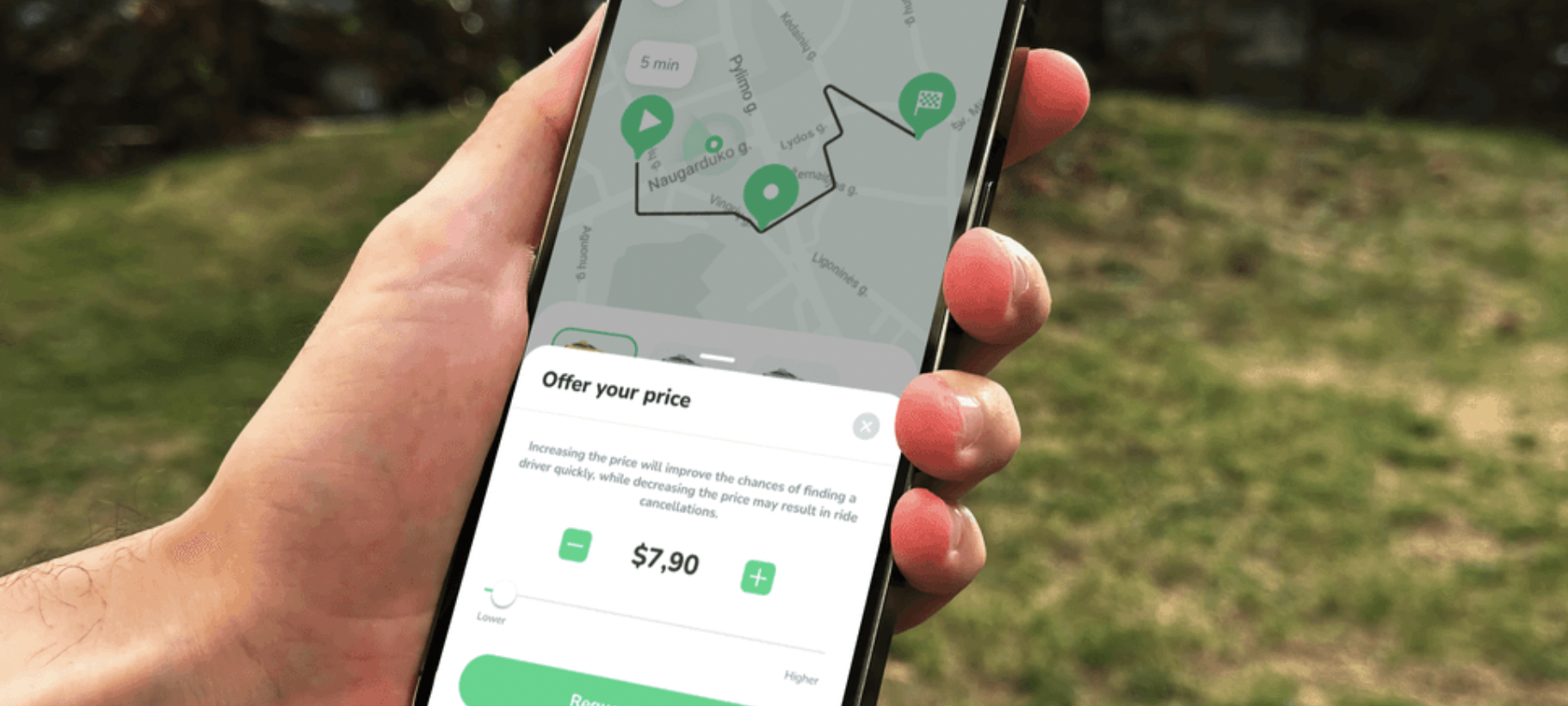

By leveraging a digital-first approach, these companies are able to optimize vehicle utilization, reduce operational costs, and offer a seamless user experience—something OEMs often struggle to achieve.

Does KIA’s Entry in Carsharing Bring New Hopes?

Amidst the shifting landscape, Kia has entered the carsharing market with its new service, Hyr & Dela. Unlike previous OEM carsharing attempts, Kia’s model focuses on businesses rather than individual consumers. This service allows companies to rent vehicles on a monthly basis and share them among employees, partners, or customers via a digital platform.

Why does this approach make sense?

- Higher vehicle utilization: By targeting businesses, Kia ensures that its vehicles are in use more frequently than traditional consumer-focused carsharing models.

- Fleet management efficiency: A B2B-focused model allows for easier scheduling, tracking, and maintenance planning.

- Electric vehicle (EV) adoption: Kia’s service aligns with the growing trend of businesses adopting EVs for sustainability goals.

If executed well, Kia’s corporate-focused carsharing model could prove to be a sustainable business approach, avoiding many of the pitfalls that plagued previous OEM carsharing attempts.

5 Lessons We Have Learned from This

So, what can current and future carsharing ventures learn from these experiences?

1. Adaptability is Key

Rigid business models and a lack of flexibility are major roadblocks to success. Carsharing services need to be highly adaptable, leveraging data to adjust pricing, fleet locations, and service offerings dynamically.

2. Cost Management Determines Longevity

Carsharing is a capital-intensive business. Operators need to optimize fleet efficiency, reduce downtime, and control maintenance and insurance costs. This is where independent operators often outperform OEMs, as they are more agile in managing expenses.

3. Technology is a Game-Changer

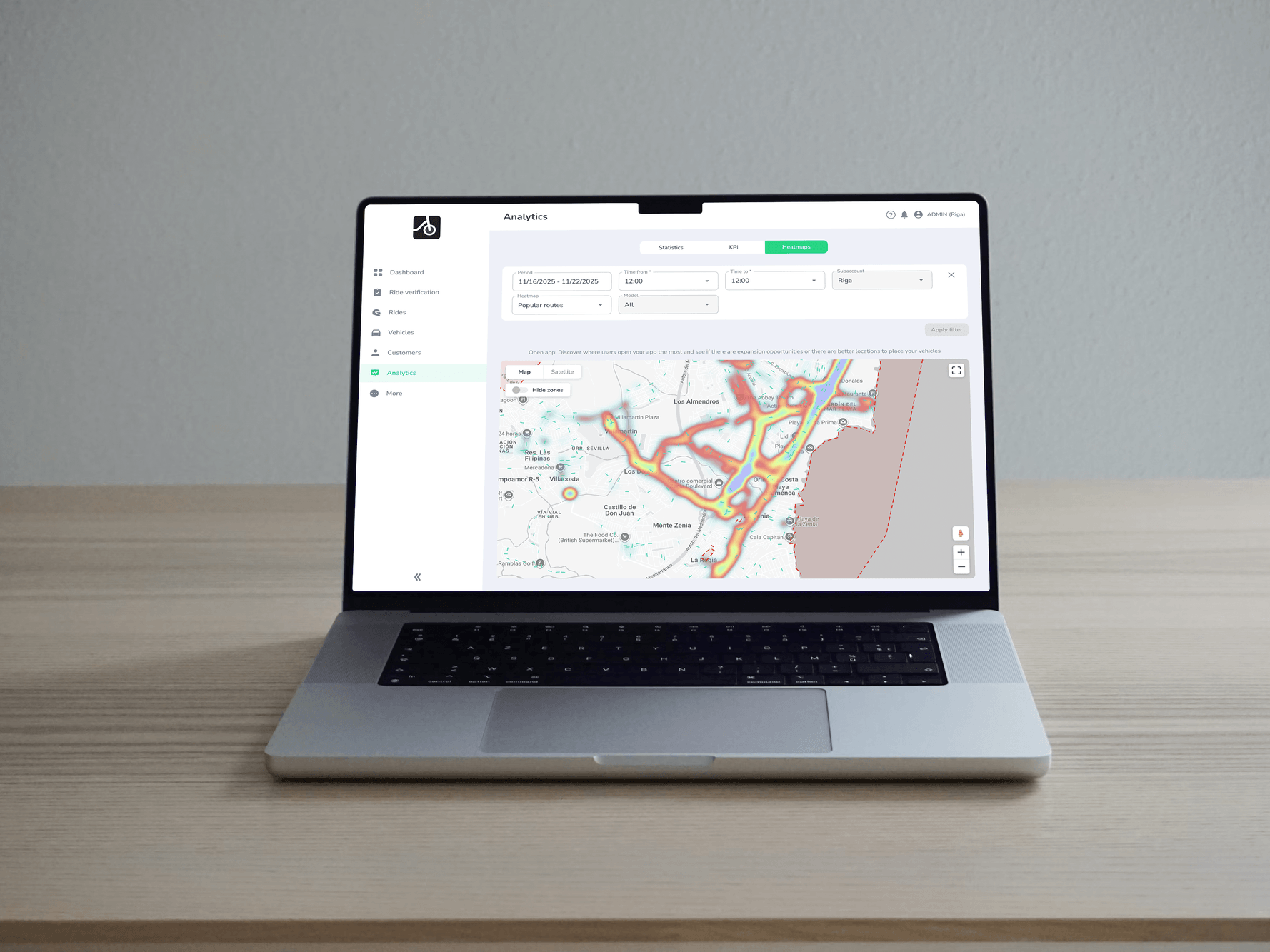

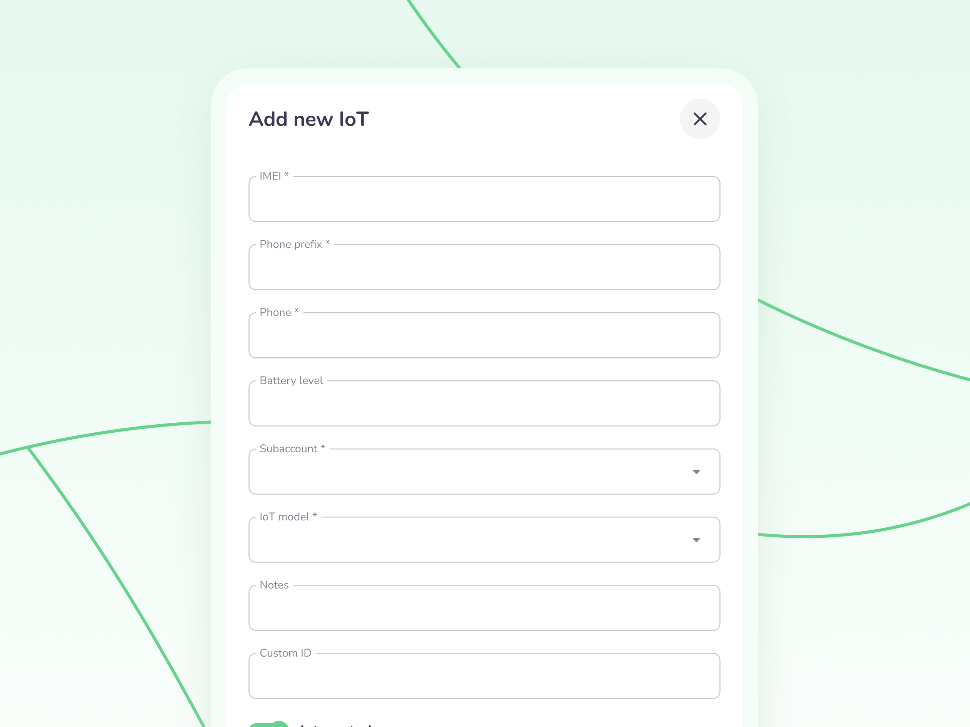

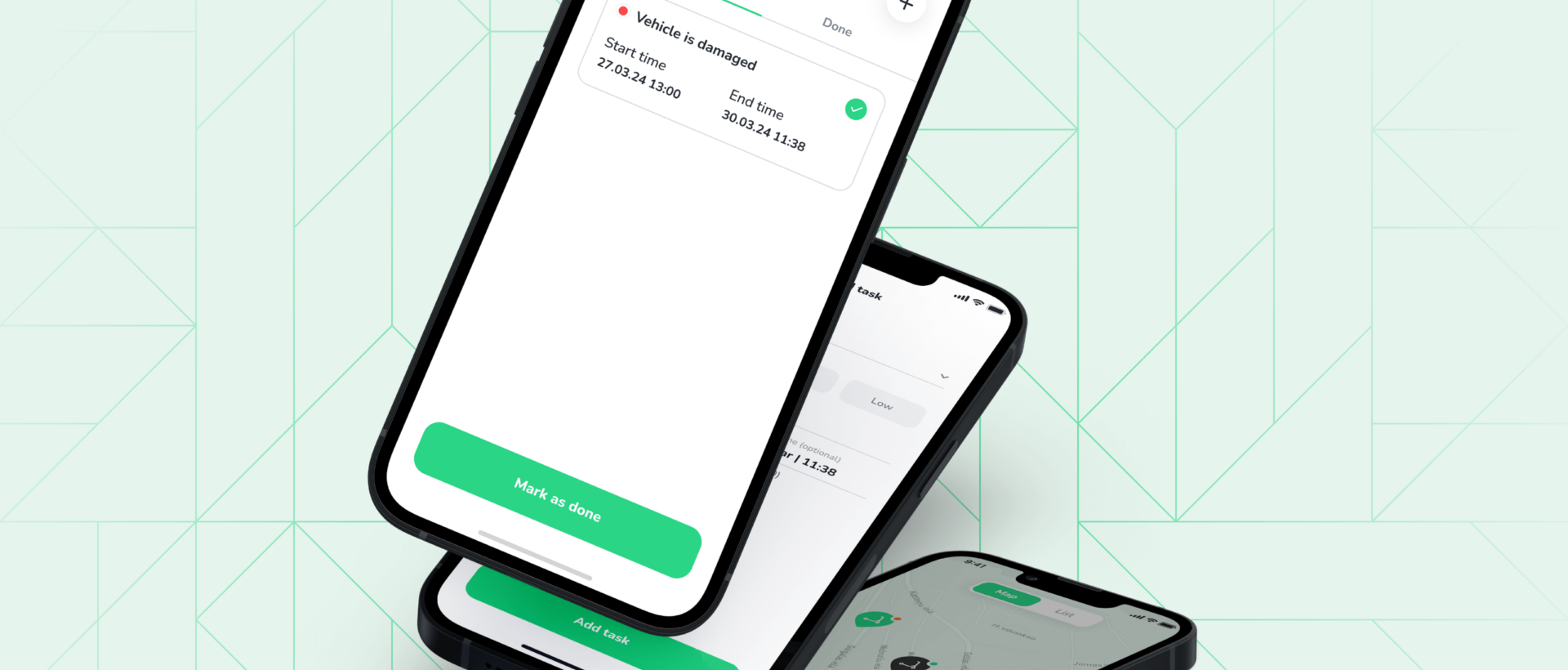

A carsharing platform is only as good as its technology. Companies partnering with mobility tech providers like ATOM Mobility can benefit from advanced booking systems, automated fleet management, and data-driven decision-making—key elements for a seamless and cost-effective service.

4. Market Selection Matters

Choosing the right city or region for carsharing is crucial. Factors like public transportation integration, parking regulations, and urban population density can make or break a carsharing business.

5. OEMs Need a Service-Oriented Mindset

Carsharing is not just about providing access to vehicles—it’s about service excellence, convenience, and user experience. For OEMs to succeed, they need to rethink their approach and adopt a more customer-centric mindset.

The Future of Carsharing

The carsharing industry is at an inflection point. While some OEM-backed services have faced hurdles, independent operators like GreenMobility and strategic initiatives like Kia’s Hyr & Dela show that success is still possible with the right approach. The key lies in adaptability, cost control, technology integration, and market focus.

As the industry continues to evolve, Kia’s entry into corporate carsharing is an exciting development. With a smart strategy and strong execution, they have the potential to carve out a successful niche in the market.

We’ll be keeping an eye on Kia’s progress and, in the meantime, wishing them the best of luck in their new venture. Let’s hope they are here to stay!

This article was originally published by ATOM Mobility.