By Isaac Bunick, CEO & Founder of MOTORMIA

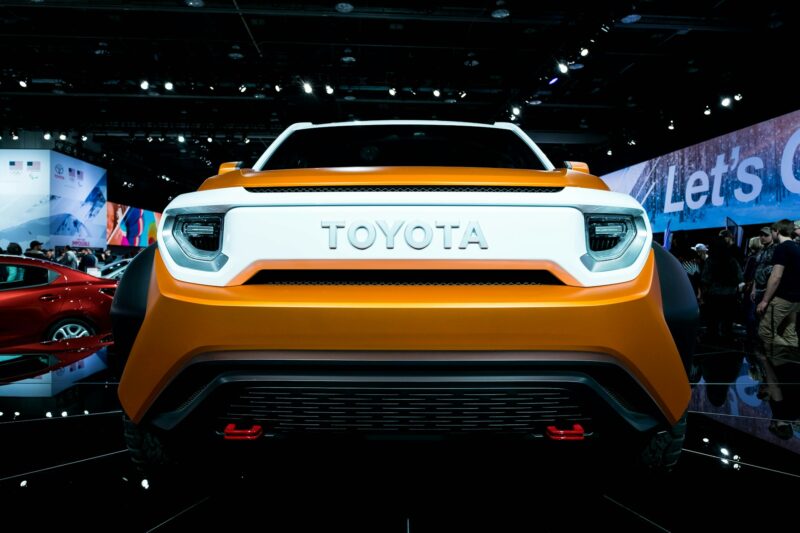

Japan’s automobile industry stands as the nation’s most vital sector, employing roughly 5.5 million people and shaping the country’s global industrial identity. In 2024, Japan produced 8.23 million vehicles, with just over half destined for export. The United States, its largest overseas market, accounted for one-third of these exports, underscoring how dependent Japan’s carmakers are on American trade policies.

When the Trump administration began, tariffs on Japanese auto imports were relatively low at 2.5%. But in July 2025, Washington and Tokyo agreed to raise the tariff to 15%, reshaping the trade balance between the two economies. While U.S. officials hailed the decision as a way to protect domestic industries and give American consumers access to potentially lower-priced Japanese cars, the agreement has placed Japanese automakers in a difficult position.

The Financial Toll of Tariffs

The impact is already visible in earnings reports. The combined hit to the operating profit of Japan’s seven largest automakers is projected at ¥2.7 trillion (18.4 billion USD). For Toyota alone, the blow amounts to ¥1.4 trillion (9.5 billion USD) for the year.

Quarterly results have revealed cracks across the industry. Nissan and Mazda both recorded net losses for the April–June period, with Mazda particularly exposed due to its reliance on U.S. exports. Mitsubishi Motors saw most of its revenue wiped out, while Honda’s profits halved. Even Toyota and Subaru, traditionally strong performers, reported earnings drops exceeding 30%.

Toyota’s own projections illustrate the scale of the challenge: in Q1 2025 alone, the automaker estimated U.S. tariffs shaved ¥450 billion (3.03 billion USD) off its bottom line, with a full-year impact of ¥1.4 trillion.

Absorb or Pass on Costs?

This situation leaves Japan’s automakers facing a critical dilemma:

- Absorb the tariffs by cutting export prices to keep vehicles competitive in the U.S. market, risking substantial profit erosion.

- Pass on the costs to consumers, potentially reducing sales volumes in an already saturated market.

Economic analysis suggests both paths are painful. If Japanese firms continue to reduce export prices by 10% to maintain sales, ordinary profits could fall by ¥1.3 trillion in fiscal 2025. Paradoxically, this would be a greater loss than a similar decline caused by reduced sales from passing costs to buyers.

As Saitō Tarō of the Economic Research Institute observed:Even if lower prices keep volume high, variable costs for things like materials will put major pressure on profits.

Robotics as a Competitive Lifeline

One way Japan’s automakers could offset these pressures is through greater reliance on automation. Car manufacturers already account for 25% of all industrial robot installations in Japan, second only to the electronics sector. In 2024 alone, automakers installed around 14,000 new robots.

Takayuki Ito, President of the International Federation of Robotics notes:Japan is the world’s predominant robot manufacturing country, representing 38% of global robot production. In terms of factory automation, Japan’s automotive industry ranked fourth worldwide with a robot density of 1,531 robots per 10,000 employees in 2023, ahead of the United States and Germany.

Investing further in robotics could help manufacturers lower labour costs, boost productivity, and protect margins at a time when tariffs are eroding profitability. While it cannot fully offset the financial impact of tariffs, automation provides a structural advantage that may allow Japanese firms to weather global trade turbulence more effectively than their rivals.

A Global Ripple Effect

Beyond Japan, the tariff restructuring has broader implications. Europe and China now face growing U.S. tariff pressure, while Mexico has toughened its stance on Chinese imports. This selective approach, rewarding favoured trade partners while penalising others, is redrawing the global trade map in real time.

Interestingly, while the vehicle export dilemma deepens, demand for Japanese auto parts remains resilient. New research from MOTORMIA, the leading digital tool for auto enthusiasts, shows that demand for auto parts in the U.S. actually rose slightly from 13.1% to 13.5% in the months following tariff implementation. This hints at enduring consumer trust in Japanese quality, even as tariffs disrupt the broader automotive trade.

The Road Ahead

Japan’s automakers now walk a tightrope. Absorbing tariffs protects sales but erodes profitability, while passing costs to consumers risks weakening demand. Either way, the nation’s largest industry, and millions of livelihoods tied to it, faces uncertainty.

Robotics may provide the efficiency gains needed to cushion the blow, but tariffs have already shifted the balance of global competition. For Japan to maintain its leadership in the automotive sector, it must lean not only on its reputation for quality but also on its strength in technological innovation. In today’s tariff-driven economy, efficiency may be just as valuable as engineering excellence.