For shared mobility operators, fleet insurance should be one of the top priorities.

No matter the size or composition of your fleet, having the right insurance can offer peace of mind by protecting your business from unforeseen situations

However, the insurance question can sometimes seem daunting – especially if you’re new to the industry. In this article, we will explore the key things you need to know about insuring your shared micromobility fleet.

Why You Need Insurance

Operating a shared mobility fleet isn’t always smooth sailing. Accidents can happen – whether it’s a minor fender-bender or something more severe. Insurance serves as your safety net, offering financial coverage for repairs, replacements, and even potential legal obligations after an incident.

Here are the main reasons why insurance should be one of the top priorities for shared mobility fleet operators:

Legal compliance: In many places, insurance for shared mobility fleets is a legal requirement. You probably want to comply with these regulations to avoid any potential fines, penalties – or even the suspension of your operations.

Financial security: Insurance also helps keep your business going financially, no matter what happens. Without insurance, accidents, vehicle damage, or theft can seriously impact your finances. Comprehensive insurance coverage can ensure that you’re not left scrambling to cover any unexpected expenses.

Understanding Shared Micromobility Insurance

When it comes to insuring micromobility fleets, part of the challenge stems from the fact that the market is relatively new. Some insurance underwriters avoid dealing directly with micromobility because it’s seen as an unfamiliar market.

This is where brokers like Cachet and others specializing in micromobility insurance come in. They partner with various insurance underwriters to provide coverage for operators in this field.

When it comes to shared micromobility, insurance coverage generally has a twofold role: safeguarding assets and handling third-party engagement in the event of accidents.

Liability coverage: Securing third-party public liability insurance for shared mobility fleets is not just a matter of choice – in some places, it’s mandated by law. This insurance serves to protect pedestrians and riders in the unfortunate event of accidents, providing financial coverage for injuries and damages that may arise. In other words, it’s a safety net that offers peace of mind to operators.

When it comes to mandatory third-party liability insurance, the negotiations with the insurance company usually begin by figuring out what the local authorities require to give them a permit. After that, the insurance policy is adjusted to meet the specific demands outlined by these authorities.

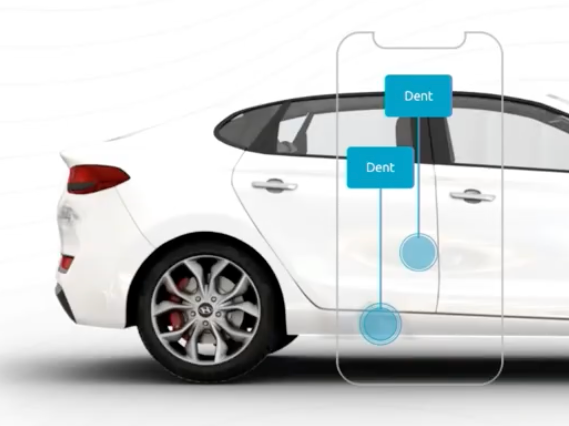

Physical damage coverage: This covers the repair or replacement costs of vehicles if they are damaged due to accidents, collisions, vandalism, or theft. Depending on the policy, physical damage coverage may also extend to equipment like GPS devices, charging stations, and other hardware.

What Decides Your Insurance Premium Payments?

The amount you’ll pay in premiums depends on various factors that are specific to your business This includes your fleet’s makeup, where and how you operate, and the level of coverage you’re aiming for.

Fleet usage: The more a shared micromobility fleet is used, the more chances there are for things to go wrong. When a fleet is in high demand and used often, there’s a greater likelihood that something might happen that requires insurance coverage.

Rider behavior: Insurance companies also consider the fleet’s ability to predict and manage undesirable rider behavior. Reckless riding, improper parking, or violating traffic rules can significantly increase the risk of accidents and incidents. Operators that have better measures in place to anticipate and mitigate such behaviors can demonstrate a lower risk profile to insurance providers.

Value of the fleet: How much your vehicles are worth individually and as a fleet will affect how much you pay for insurance. If your vehicles are expensive, your insurance premiums will be higher because it would cost more to replace them if they get damaged or lost.

Size of the fleet: Operators can often negotiate more favorable insurance rates for proportionally larger fleets. As the number of vehicles increases, the overall expected risk is distributed and “diluted” as a result – which translates to lower premiums per vehicle.

However, some brokers like Cachet have embraced a broader approach, ensuring that smaller and medium-sized fleets can also benefit from insurance coverage.

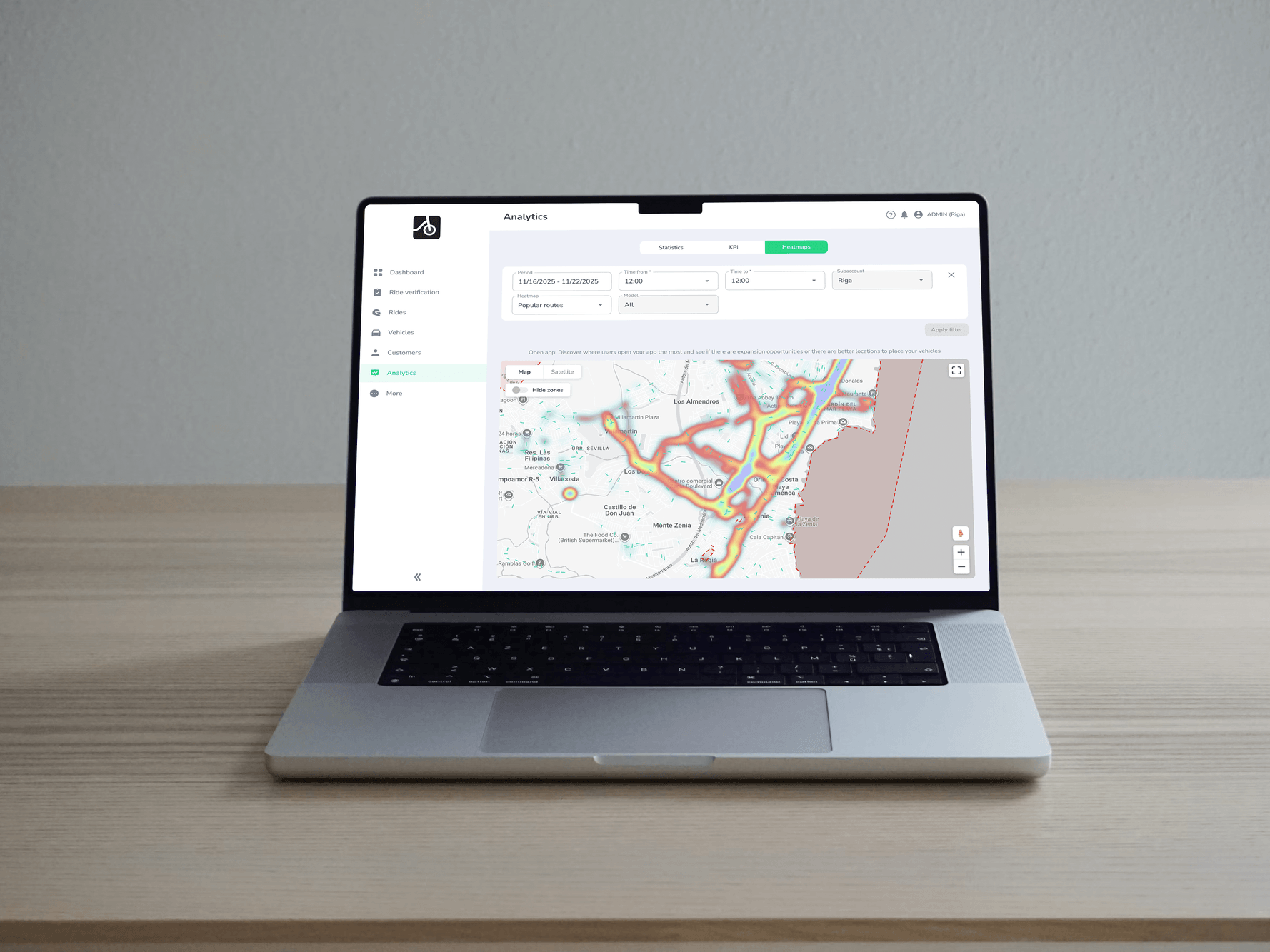

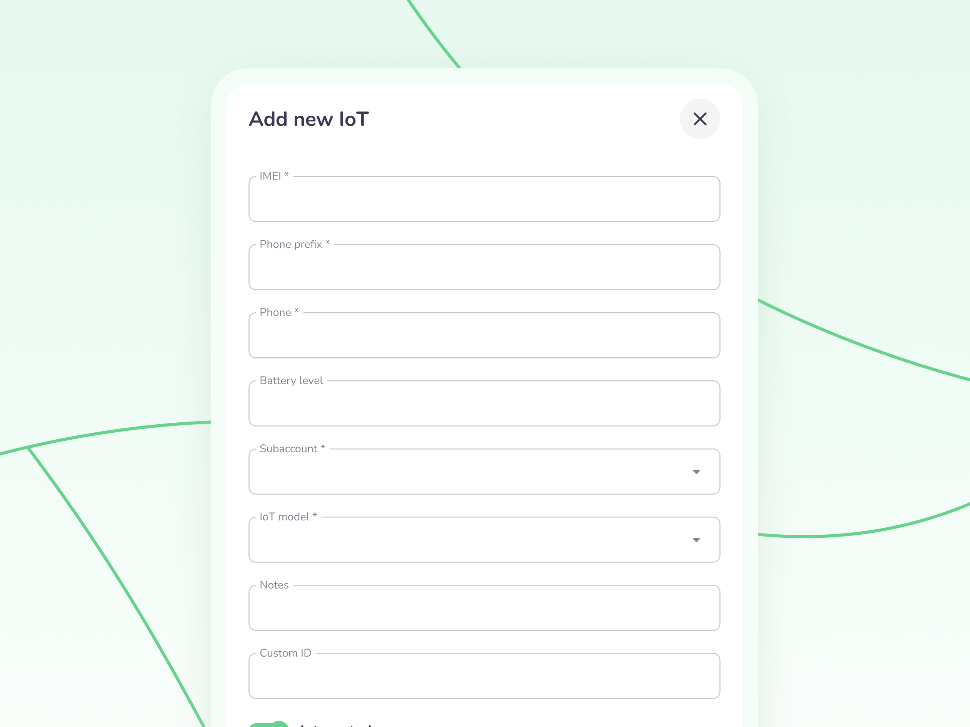

Technology implementation: Shared mobility services that employ technologies like GPS tracking, telematics, and IoT devices can provide insurers with valuable data. This data can then help assess driver behavior and usage patterns, enabling insurers to offer more accurate and tailored premium rates. This also takes into account how simple it is for scooters to be stolen and how well the recovery processes function – which can also play a role in insurance expenses.

Where you operate: The location in which your fleet operates is another important factor. From the insurer’s perspective, different areas pose varied levels of risk. For example, urban mobility – which is associated with a higher risk of accidents – may incur higher premiums compared to vehicles used in rural areas.

Level of coverage: The level of coverage you choose directly affects how much you pay in premiums. Opting for higher coverage limits means you get more comprehensive protection, but obviously, it also means your insurance costs go up.

Choosing the Ideal Insurance for Your Fleet

Every shared mobility fleet and business is different, so your insurance needs will depend on things like the type and size of your fleet, where you operate, how much risk you’re comfortable with, and of course – how much you are willing to pay.

For example, do you require coverage for specific risks, like vandalism, or perhaps your fleet is composed of premium vehicles that are more expensive? To make it more relatable, let’s dive into a practical case of a shared micromobility operator’s experience with insurance.

How Hoog Found the Right Insurance With Cache

The concept behind Hoog Mobility is to revolutionize transportation in smaller Estonian towns. They recognized the need for efficient and eco-friendly local travel and brought a shared mobility solution often seen in big cities but missing in smaller communities: electric scooters.

Cash-strapped mobility startups often worry about potential damage or vandalism happening to their shared vehicles. This concern is shared by traditional insurance companies too. As a result, these insurers might hesitate to provide coverage for shared scooters, and if they do – it’s usually at a higher cost.

Faced with this challenge, Hoog initially operated without insurance due to the steep expenses. But that changed when Cachet provided them with a customized insurance solution that perfectly suited the company’s needs. Hoog also realized that the initial worry about vandalism wasn’t as much of an issue as they thought. But still – having insurance for their fleet turned out to be a sound financial decision that gave them peace of mind.

Concluding Remarks

Don’t underestimate insurance – it’s just as crucial as having a top-notch fleet and solid software. Insurance is best approached proactively – discovering you’ve cut corners after an unforeseen event will cost you significantly more.

Getting insurance for shared micromobility might be a bit trickier since it’s still a new concept, but we’ve seen that even smaller fleets can make it work – it’s just a matter of finding a suitable partner who understands your needs.

At the end of the day, insurance isn’t merely about meeting legal requirements – it showcases your dedication to safety, responsible operations, and the well-being of everyone involved in your mobility business.

This article was originally published by ATOM Mobility.