Electric Car Prices and Uncertainty about Charging Availability Remain the Biggest Obstacles to EV Adoption in Europe

Electric mobility is crossing the chasm—from being an emerging technology for innovators and early adopters to becoming a stable and accessible option for an early majority. The industry could see an exponential rise in EV adoption if main barriers such as more affordable price ranges for electric cars and uncertainty of charging availability are removed.

More European citizens are inclined to purchase an electric car (44 percent) compared to almost two years ago, and a great deal of current electric vehicle (EV) drivers (79 percent) would opt for an EV again. Nevertheless, the industry is still facing some challenges when it comes to making the switch to a sustainable form of transport more attractive to doubters.

These are some of the initial findings from this year’s edition of the EVBox Mobility Monitor—EVBox’s market research report on EV adoption conducted alongside Ipsos. The research is supported by responses from over 4000 European citizens across four countries: the Netherlands, France, Germany, and the UK.

Less concern about charging availability but it remains one of the main barriers to mass EV adoption

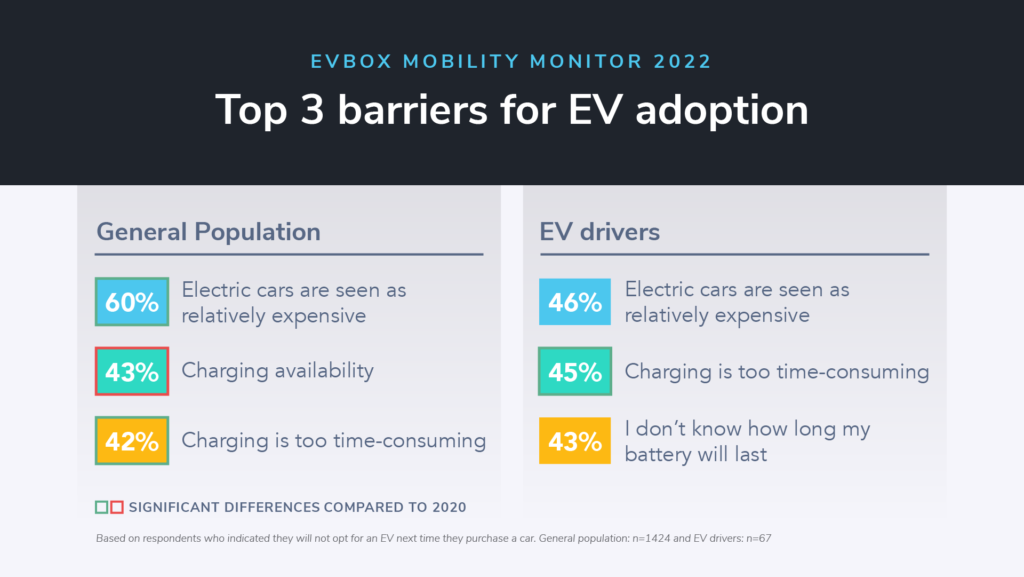

Across all four countries, the price of electric cars is the main reason why European citizens are not making the switch to an electric vehicle (60 percent). This number has significantly increased in Germany (from 40 to 61 percent) and the Netherlands (from 54 to 66 percent) compared to the figures from the 2020 EVBox Mobility Monitor report.

As the second most prevalent reason, the uncertainty of where and if they will find a charging station when they need one (43 percent) continues to be an important block to the mass adoption of electric mobility. Nevertheless, the concern regarding low charging port availability has decreased by five percent. Additionally, the assumption that charging is more expensive than gasoline is less prevalent than before (25 percent in 2022 compared to 33 percent in 2020). Finally, four out of ten Europeans think that charging EVs takes too much time.

Once an EV Driver, Always an EV Driver?

Similar to the concerns of the general population mentioned before, some EV drivers said they would not choose an electric car again, citing that they are too expensive as the main reason why (46 percent*). The price barrier is especially high in the Netherlands (71 percent*); while UK EV drivers fear that the current range of EVs does not fit their driving behaviour. Charging electric cars takes too long for 45 percent of EV drivers (increased significantly from 2020 by 19 percent*). One more important concern for drivers is battery life—how long will it last?

However, on a more positive note, 79 percent of the EV drivers would opt for an electric car again. Current EV drivers are confident that they can pay at any charging station without much hassle (52 percent) and fewer EV drivers think that the cost of charging is higher than for fueling (this number decreased significantly from 26 percent to only 11 percent of EV drivers). The assumption that the maintenance of electric cars is more expensive than that of petrol/diesel vehicles decreased significantly as well—from 27 percent to 17 percent. Looking at the general population, the Dutch are the most confident that payments at stations will not cause them any problems.

Four out of ten European citizens see electric cars as an important element to combating climate change

Climate change is still considered an important topic among the respondents (64 percent). One option available to help tackle the climate crisis is to reduce CO2 emissions in transportation. 4 out of 10 European citizens continue to believe that transitioning to electric mobility is a relevant way to reduce emission. Additionally, half of European citizens, and around 70 percent of (potential) EV drivers, consider environmental aspects when buying a car.

The majority of people inclined to switch to electric mobility also expect their government to prioritize policies that protect the environment (78 percent), and this expectation is reflected as well in the general population (63 percent). UK citizens are now even more in favor of giving additional tax credits to people buying electric cars (56 percent compared to 48 percent back in 2020).

Around 60 percent of European citizens doubt the prospect of completely phasing out petrol/diesel cars by 2030

As part of the European Green Deal, the EU has expanded its ambition and committed to cutting emissions by at least 55 percent by 2030. Six out of ten respondents from France, Germany, and the Netherlands do not consider a complete phase-out of petrol/diesel cars feasible by 2030 (59 percent).

Nevertheless, around seven out of ten (potential) EV drivers believe that the targets related to improving the EU’s EV charging infrastructure can be met. Those plans include placing one charging port every 60km along most roads and highways, optimizing the user experience, and making the payment options more transparent. Regarding the adjustment and removal of tax exemptions and other incentives concerning fossil fuels (having the most polluting fuel be the one taxed the highest, for example), more than half of the general population and 71 percent of potential EV drivers think the goals are achievable.

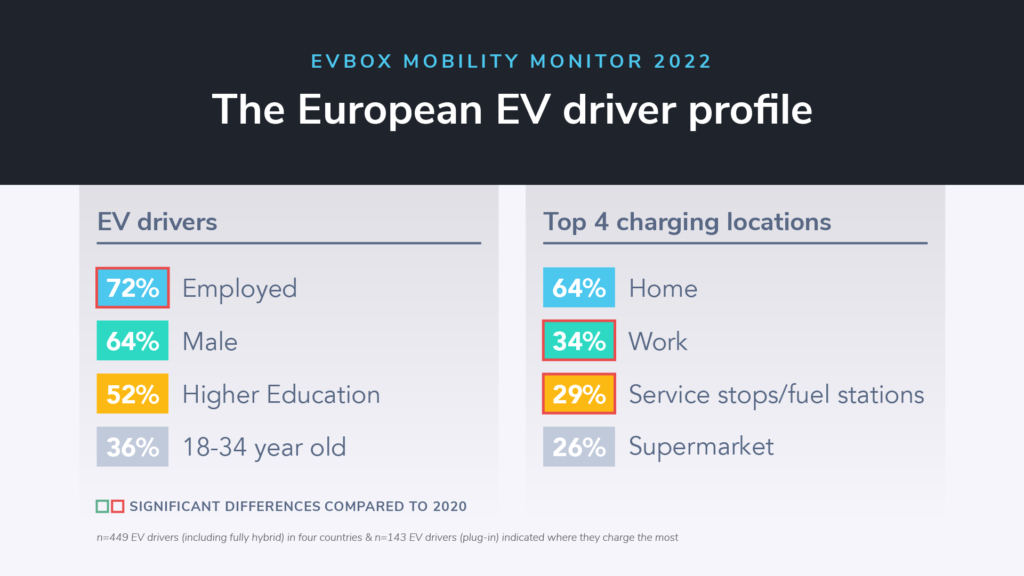

Even though EV drivers are starting to resemble the general population, the current European driver is still predominantly male, highly educated, and employed

The results of the report show that 94 percent out of 449 EV drivers own a private car, and 23 percent of them also drive an additional business car. They mainly drive hybrid vehicles (63 percent), followed by BEVs (31 percent), and PEVs (20 percent*).

The driver profile in 2022 looks very similar to the one from 2020; EV drivers are predominantly male, highly educated, and employed. The prominence of male EV drivers is particularly high in the Netherlands (74 percent). The percentage of female EV drivers in Germany (43 percent) increased by 16 percent compared to the last edition of the report.

Where Do EV Drivers Charge?

EV drivers charge their cars mostly at home (64 percent*), followed by their workplace (34 percent), public and commercial parking spots (31 percent*), service stops and fuel stations on highways (29 percent*), and supermarkets (26 percent*).

When asked where they would like to see more charging opportunities, supermarkets are the most mentioned place (37 percent*)—especially in Germany (50 percent*).

What Do EV Drivers Look For in a Charging Station?

When asked which features they prioritize when purchasing an EV charging station, energy efficiency (65 percent*) and an easy-to-use interface (54 percent*) are named as the top two most important features.

Four out of ten EV drivers usually don’t experience any problems when charging

The most common issue EV drivers face when wanting to charge their car is having to wait a long time due to a station being occupied (33 percent*). This shows that more public charging ports are necessary to increase EV adoption in Europe. 28 percent* of EV drivers report that a station was out of order when they intended to charge their car and 18 percent* struggle with their charging card not being accepted.

This time around, fewer people think that owning and driving an EV takes more effort than a petrol/diesel car but there is still a great deal of division, with Dutch EV drivers being the least concerned about it (44 percent* compared to 24 percent* in 2020). Almost half of EV drivers in the UK think that an electric car takes more effort (49 percent*).

Remco Samuels, Interim CEO at EVBox said:An EV is a long-term investment that is, in many cases, less expensive than a petrol or diesel car in the long run. However, as the results of our market research show, many among the general public are unaware and still see price as a barrier to start driving electric. As an industry, we need to clarify that even while the initial costs of an EV compared to a petrol or diesel car may be higher, the maintenance and charging costs of EVs are significantly lower. I am pleased to see that many people do consider driving electric a part of the solution to climate change. At EVBox, we keep ourselves accountable to work together with other players in the market to ensure that the main barriers of EV adoption are removed for those who want to make the switch to electric. Governments, car manufacturers, charging station manufacturers, and other businesses need to step up and play an active role in this transition.

Check Out the Full EVBox Mobility Monitor Report

Dive into the insights, the full results, and all the data in the EVBox Mobility Monitor 2022. You can access it here. For country-specific insights, access the following press releases: The Netherlands, the UK, Germany and France.

This article was originally published by EVBox.