By Aniket Roy, Senior Business Analyst at Stratview Research

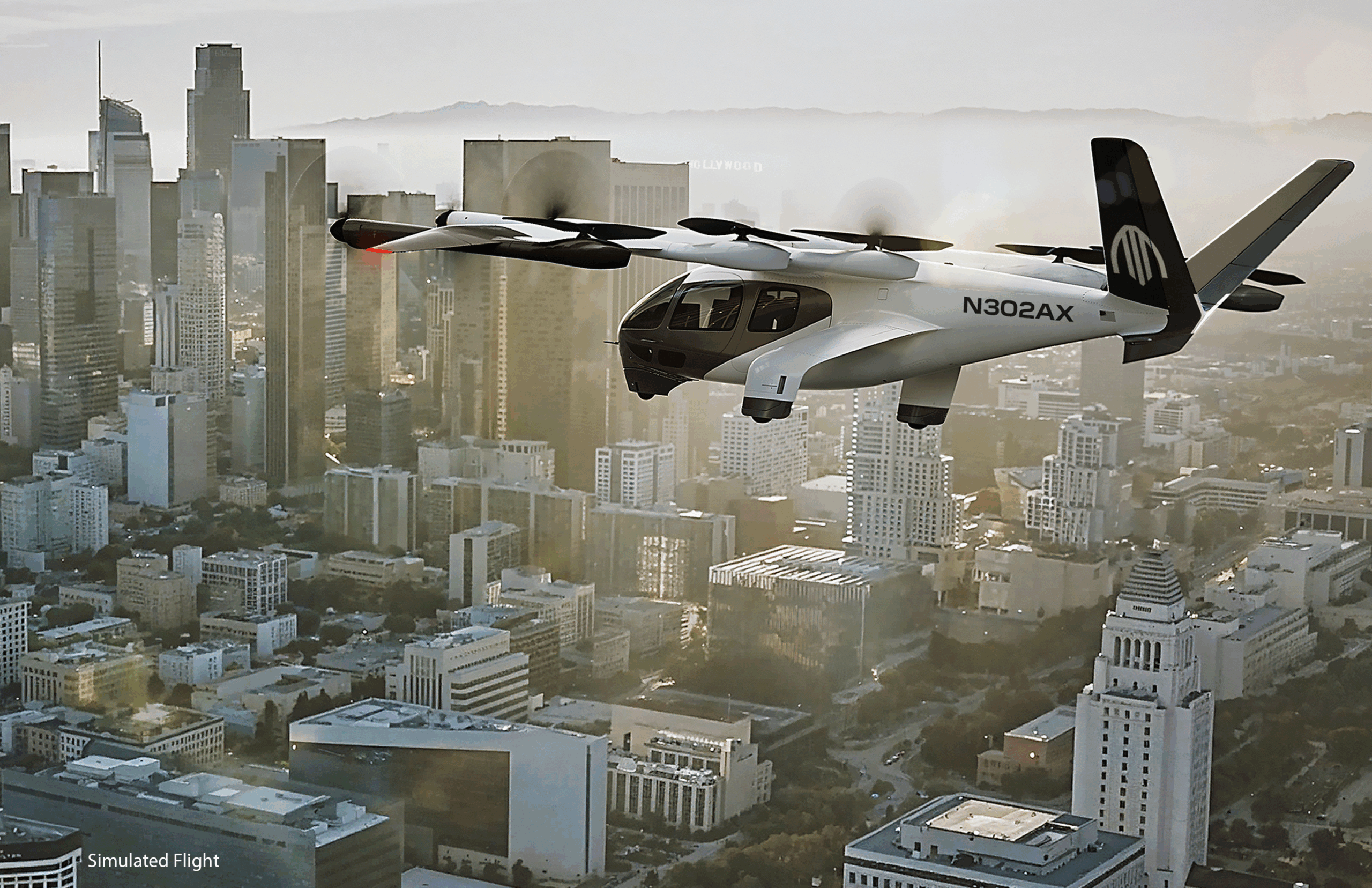

Ask any popular AI text-to-image generator on the web to imagine a metropolis like New York, Los Angeles, Paris, or Berlin in 2030, and you’ll see several images with tall buildings, crowded streets, cars on the road, and surprisingly, lots of ‘flying cars’ too.

While it’s difficult to pinpoint the exact guidelines that made the AI model draw flying cars, it’s interesting that even AI models think cities like New York and Los Angeles will have flying cars by 2030.

Man’s vision of ‘flying cars’ is being realised through the development of electric Vertical Take-Off and Landing aircraft (eVTOL). Though still in the pre-commercialisation stage, the industry is being conferred upon with high positive sentiments from both investors and potential buyers alike.

As of Sep 2024, the eVTOL industry has seen investments worth over 7 billion USD and has a collective tentative order pipeline of ~20,000 aircraft. Interestingly, 2024 was the initially proposed year for Entry Into Service (EIS) by many headline players like Joby Aviation, Lilium GmbH, Volocopter, Archer Aviation, etc.; which has now been postponed to at least 2025. The key reason behind the delay is the stringent certification process from the regulatory authorities like the FAA, EASA, etc.

Certification: The Heaviest Load for eVTOL OEMs

Even with sufficient availability of production capital, capacity, and order pipeline, the ‘take-off’ of eVTOLs has been impeded significantly because of the lengthy certification process.

Currently, the certification process is as big a challenge for the OEMs as for the regulatory authorities because the standards for certification need to be defined.

Major authorities are collaborating closely, not just with the OEMs but also among themselves, to ensure a smooth certification process. Some notable inter-authority collaborations for boosting eVTOL licensing and certification include the FAA and the UK Civil Aviation Authority’s collaboration in March 2022, the FAA and the Korea Office of Civil Aviation in January 2023, and recently, between the FAA and EASA in June 2024.

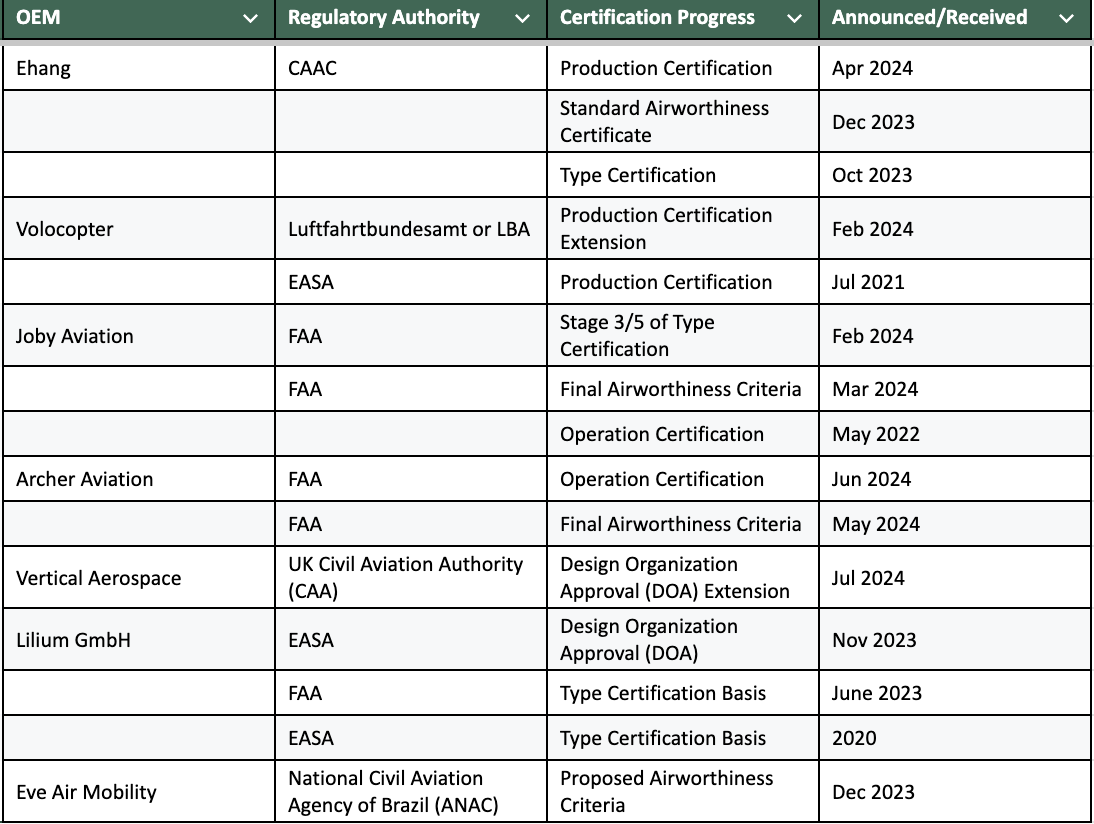

Though varying from one regulatory authority to another, the certification process of eVTOLs can be majorly divided into the following 4 types:

- Type Certification (where the design of the aircraft gets certified)

- Production Certification (where companies are granted mass production permission)

- Operation Certification (which certifies the OEM to operate their aircraft commercially)

- Airworthiness Certificate (which certifies an individual aircraft for flight)

As of September 2024, no OEM has received all four, and >80% of the OEMs don’t have their certification basis confirmed with the respective regulatory authorities. The following table shows the certification status for some of the OEMs who are ahead of others in the certification track.

Based on the certification progress and the commercialisation targets, OEMs like Ehang, Joby Aviation, Archer Aviation, and Volocopter can be expected to start their services by the end of 2025, and between 2025-2030, the industry can expect ~15 commercially operational OEMs.

Other Indispensable Loads

In addition to certification, another major challenge that will impact the widespread adoption of eVTOLs is the lack of infrastructure to support UAM.

Since eVTOLs are a modern innovation, naturally no city comes equipped with the required infrastructure. The installation of vertiports will thus be required to commence operations.

The catch is that not every metro city can be turned into a UAM-friendly city. Based on UAM infrastructure ranking by regulatory bodies like EASA, and operation expansion targets by major OEMs, there are ~40 cities globally that are infrastructurally ready to support UAM operations.

Paris, New York, Los Angeles, Dubai, etc. are among the top target cities for the launch of UAM operations.

From a consumer’s perspective, the challenges majorly concern noise, safety, willingness to pay, and the privacy of the residents of the urban and suburban areas.

A Rising Market Despite the Loads

Despite the challenges faced by the OEMs, the outlook for eVTOLs is positive throughout the value chain.

According to a 2021 survey conducted by the EASA in major cities in Europe, ~80% of the population has a positive outlook for eVTOLs and ~70% are interested in trying out any one of the potential services to be offered by eVTOLs.

With pre-filled order books, almost every major OEM has ‘rapid scaling’ as the next plan once they hit the commercialisation stage. As per their respective recent investor presentations, OEMs like Joby, Lilium, Vertical Aerospace, Archer Aviation, and Eve Air Mobility are all planning to produce 500+ units annually within 3 years of commercialisation.

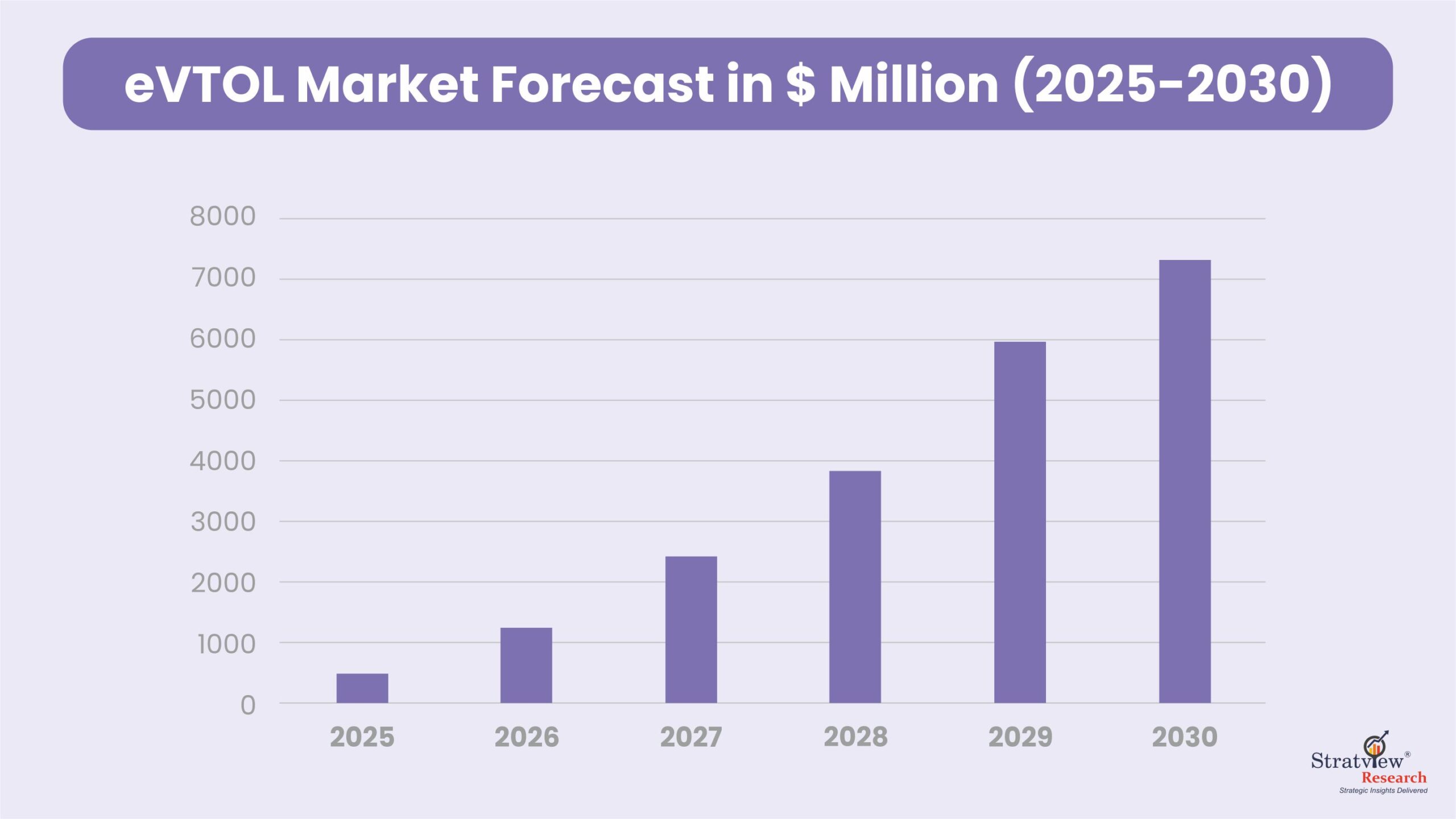

With a positive outlook throughout, combined with high volumes of pre-orders, the market for eVTOL OEMs is expected to exceed 7 billion USD by 2030, according to a report from Stratview Research.

The report also states that during the initial years i.e. 2025-2030, the market will witness a CAGR of >60%, which will eventually come down to ~30% after 2030. One of the key reasons behind this decline will be infrastructural limitations, which will prevent the expansion of eVTOLs beyond a certain number of cities.

~80% of the current market players have air taxis as their primary application focus, while other applications like cargo, tourism, and emergency response are also being explored by a few.

Among the air-taxi intended models, the apparent focus is on developing higher seating capacity models that would translate to more revenue per trip and thus per aircraft.

The intended application also plays a key role in choosing the design type for the aircraft model. Since the majority of the OEMs are focusing on applications that would require both speed and a high lifting capacity, vectored thrust (tiltrotor) and lift + cruise configurations are the most logical choices. Of which, vectored thrust is the preferred choice for both present as well as upcoming models.

Of the four common configuration types, namely vectored-thrust, lift + cruise, multirotor, and hoverbikes, vectored thrust models will comprise ~45% of the eVTOL market during 2025-2030, owing to their superior lifting and cruising capabilities over other configuration types. However, the penetration of other configuration types can be expected to increase with increasing lightweight applications like surveillance, personal travel, and low passenger-capacity intercity trips.

The Future Trajectory: Bright or Cloudy?

The buzz for eVTOLs can be heard throughout the mobility sector and, investments and participation from existing automotive OEMs like Toyota, Stellantis, Honda, etc., and aerospace OEMs like Boeing (Wisk Aero) and Airbus are proof of the widespread interest.

The revolution that eVTOLs can bring to the mobility sector has been recognised not just by the industry, but by governments as well. Governments of both developing and developed countries have announced collaborations with OEMs to facilitate smooth operations of eVTOLs once certified.

In March 2024, the UK government published its ‘Future of Flight’ action plan which mentioned that air taxi services will be a part of the regular life in the UK by 2028. In Q1 2024 only, Joby Aviation and SkyDrive Inc. have entered into agreements with the governments of UAE and India respectively to explore eVTOL operations.

Additionally, the UK and Japan have also provided financial backing worth 10 million USD and 82 million USD to Vertical Aerospace and SkyDrive respectively, for the development of eVTOLs.

While collaborations with governments, combined with the existing pre-orders from several huge airlines surely paint a beautiful picture for eVTOL OEMs, the year 2024 has also revealed how the lengthy pre-commercialisation stage is becoming a challenge.

In April 2024, Germany-based Volocopter GmbH announced that it might have to look at insolvency options, but later on, received new funding from its existing investors in June. In May 2024, the CEO of Munich-based Lilium GmbH told the German media that Lilium might have to exit Germany if it fails to secure funding from the German Government.

While setbacks such as funding gaps and prolonged certification timelines highlight the complexity of bringing eVTOLs to market, the momentum in global partnerships and the strategic backing of key players indicate that the sector is poised for transformation.

As governments and industries continue to align their efforts, the next few years will likely determine which companies will successfully conquer the Urban Air Mobility space.

Aniket is a Senior Business Analyst at Stratview Research, with over 6 years of specialised experience in the Mobility, Defense, and Composites domain. He has contributed to numerous articles and thought leadership reports, offering key insights that have shaped industry discussions. His analytical expertise and in-depth knowledge has been recognised in globally renowned magazines, positioning him as a trusted voice in the field.