AustoSens Brussels showcased the latest developments in automated driving (AD) and advanced driver assistance systems (ADAS). In doing so, the event provided insight into the sector’s ongoing progress and its near and long-term aims and expectations.

Currently, the growing number of proven autonomous technologies is driving speculation as to when assisted and automated driving will become more widespread on roads.

During an opening session entitled, “AutoSens Interviews ChatGPT,” the Sense Media team asked ChatGPT about its expectations for a future timeline. In response, the AI technology acknowledged that the rollout of autonomous vehicles would depend on several factors, including technological advancements, regulatory approvals, public acceptance and infrastructure development.

For the course of the event, the conference stage was then handed over to the human professionals to explore how these factors are progressing and what their development means for the future.

In his review of the past two years, Asif Anwar, Executive Director of Automotive End-Market Analysis at TechInsights noted the significance of Ford and Volkswagen’s decision to shut down their Level 4 autonomous vehicle company, Argo AI to instead focus on developing Level 2+ and Level 3 technologies. Following this announcement, Ford formed Latitude AI in March 2023 with the aim of producing a Level 3 ‘hands-off, eyes-off’ system.

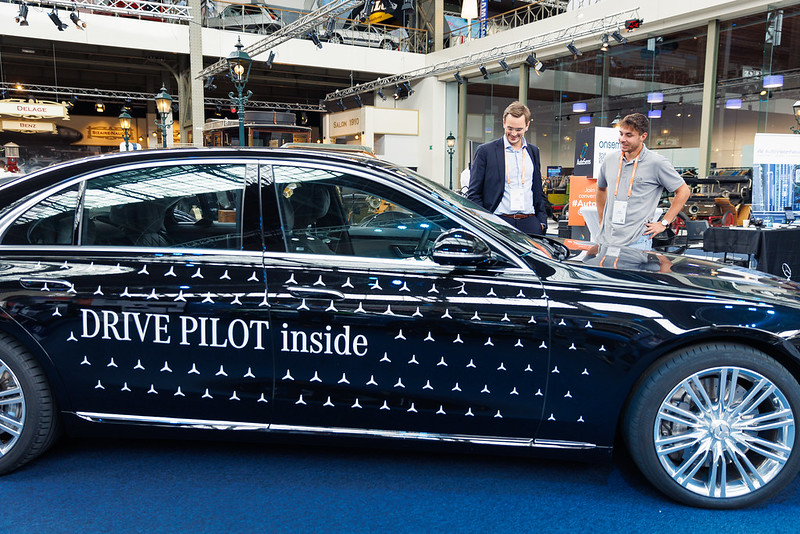

Meanwhile, Mercedes‑Benz has commenced deployment of its DRIVE PILOT SAE Level 3 automation system. In Europe, this system is currently approved for use on approximately 13,000 kilometres of German highway at speeds of up to 60 kilometres per hour.

Anwar stated that with such developments, these OEMs are part of the industry’s pivoted focus on ADAS technologies, rather than greater levels of automation. Consequently, TechInsights predicts that in the coming years, the market for AV sensors will remain most prominent for Level 2+ systems, with the production of fully autonomous vehicles remaining infrequent.

Despite an increased focus on Level 3, Anwar also argued that the mainstream rollout of these systems currently remained hindered by accountability issues for edge cases. Indeed, the jump from Level 2 to Level 3 is significant, as Level 3 allows the driver to take their eyes off the road, leaving all immediate actions such as emergency braking to the car.

In support of this viewpoint, Michele Richichi, Autonomy Principal Analyst at S&P Global likewise stated that Level 2 and Level 2+ technologies would remain dominant over the next decade. In Europe, mandated Level 2 ADAS features on new cars, including advanced emergency braking, intelligent speed assistance, lane-keeping assistance and vulnerable road user detection, will standardise certain levels of automation.

Meanwhile, Richichi predicted that Level 2+ automation, such as Ford’s BlueCruise system, would remain an optional, high-cost convenience for consumers. By extending the capabilities of a vehicle’s mandatory sensors, these paid-for systems can help OEMs recoup the cost of deploying ADAS.

Richichi also noted that the in-cabin market is currently growing rapidly thanks to the EU’s General Safety Regulation (GSR). This is due to the need for driver monitoring systems (DMS) to be installed in new vehicles to detect states such as fatigue and distraction. In turn, these systems will also help accelerate the rollout of Level 2+ systems by enabling the car to monitor whether the driver is adhering to the requirements of “hands-off eyes-on” driving.

Despite these market predictions, companies across Europe are continuing to invest in testing and validating self-driving technologies. Indeed, at AutoSens, rFpro announced its position as a consortium partner in two government-funded projects: DeepSafe and Sim4CamSens. These projects have been awarded a share of 18.5 million GBP in government funding to help overcome barriers to the commercialisation and deployment of self-driving vehicles.

What’s more, in Asia and the US, a low volume of Level 4 autonomous vehicles continue to be deployed for commercial operations. Here, the increased demand for robotaxi services is driving the development of Level 4 automation. This can be seen in the success of companies such as Baidu in Asia and Waymo in the US.

In the long term, ongoing success in these continents could also lead to equivalent services arising in Europe, enabled by the EU’s 2022 regulation for the type approval of fully automated vehicles. Indeed, at AutoSens, Dr Trent Victor, Director of Safety Research and Best Practices at Waymo affirmed that Europe is a potential future market for the company’s expansion.

However, in the near term, AutoSens highlighted how the array of technological developments in the sensor industry will predominantly be used to continually enhance safety through ADAS applications. With greater rollout, this technology can contribute greatly towards Vision Zero efforts, while also paving the way for higher levels of automation and higher safety standards in the future.

Arguably, this places Europe behind the US and Asia in the journey to deploying Level 4 vehicles, despite leading in the rollout ADAS technologies under EU regulations.

With this in mind, when AutoSens returns to Detroit next year, it will be telling to see whether discussions regarding the roadmap to automated driving in North America differ significantly from those that took place this month in Brussels.